10 crore vs 1 Rupee (Power of compounding)

Imagine you’re offered a seemingly impossible choice by a mysterious benefactor:

Option 1: You receive Rs. 10 crore today, no strings attached.

Option 2: You start with Rs. 1 today, and the amount doubles every day for 30 days.

At first glance, Rs. 10 crore might seem like the obvious choice. Who wouldn’t want to become a crorepati instantly? But let’s dive into the math and unravel the hidden potential behind the second option.

Spoiler: the outcome might surprise you and offer valuable insights into the importance of investing, saving, and the magical power of compounding.

Table of Contents

ToggleBreaking Down the Numbers

Practical examples of compound interest – Compound interest explained – 10 Crore vs 1 Rupee

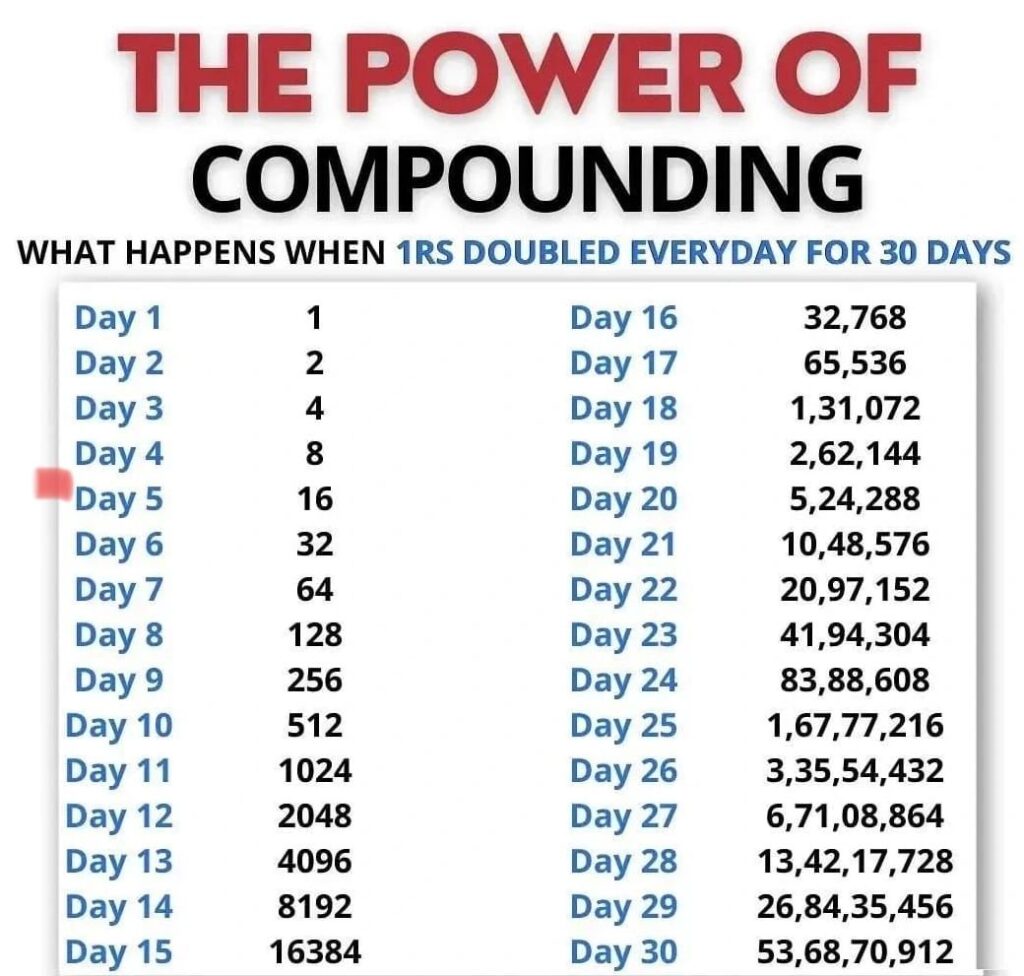

If you choose Option 2, here’s how your money grows daily:

Day 1: Rs. 1

Day 2: Rs. 2

Day 3: Rs. 4

Day 10: Rs. 512

Day 20: Rs. 5,24,288

At Day 20, the growth seems significant but still nowhere near Rs. 10 crore. However, compounding works its magic in the final stretch:

Day 25: Rs. 1,67,77,216

Day 30: Rs. 53,68,70,912

Yes, you read that right! By the 30th day, the amount from Option 2 reaches a staggering Rs. 53.68 crore, dwarfing the Rs. 10 crore offered upfront in Option 1. This example is a masterclass in understanding exponential growth and the power of compounding.

The Power of Compounding

Compound interest explained

Compounding, often referred to as the eighth wonder of the world, is the process where your investments grow not just on the principal amount but also on the returns accumulated over time. In our example, the doubling each day mirrors the concept of reinvestment and exponential growth. Let’s explore its significance in real-life financial planning:

Time is Your Best Friend: The longer you stay invested, the more significant the compounding effect becomes. Starting early can make a small amount grow into a substantial corpus over time.

Patience is Key: As seen in the example, the first 20 days show modest growth, but the real magic happens in the final stretch. Similarly, in investing, patience often leads to rewarding outcomes.

Small Beginnings Can Lead to Big Results: Starting with just Rs. 1, the outcome reached over Rs. 53 crore in 30 days. This emphasizes that consistent saving and investing, even with small amounts, can yield significant returns over time.

Lessons for Everyday Financial Planning

While the above scenario is hypothetical, it’s a powerful metaphor for real-world financial decisions. Here are some key takeaways:

1. The Importance of Investing

Leaving your money idle is like choosing Option 1 without considering its potential. Investing allows your money to work for you, enabling growth beyond the initial amount.

2. Start Early and Stay Consistent

Why investing early matters ?

The earlier you start investing, the more time your money has to grow. Even small, consistent contributions to your investment portfolio can make a substantial difference over decades.

3. Understand the Value of Patience

Financial growth doesn’t happen overnight. It’s easy to get discouraged during the initial phases, but as the example shows, perseverance is key.

4. Savings vs. Investments

While saving is essential for short-term goals and emergencies, investing is critical for long-term wealth creation. The key difference lies in the growth potential—investments harness the power of compounding, while savings offer limited returns.

5. Be Mindful of Inflation

Inflation erodes the value of money over time. Rs. 10 crore today might not hold the same purchasing power 10 or 20 years from now. Investments can help combat inflation by growing your wealth at a higher rate.

Applying These Principles to Your Life

Set Financial Goals: Identify short-term and long-term objectives. This clarity helps determine how much to save and invest.

Leverage Compound (Power of compounding) Interest: Opt for investment vehicles that allow your returns to reinvest, such as mutual funds, stocks, or fixed deposits with compounding interest.

Diversify Your Portfolio: Avoid putting all your eggs in one basket. Diversification reduces risk while maximizing returns.

Regularly Review Your Investments: Monitor your portfolio to ensure alignment with your goals and make adjustments when needed.

A Final Thought

The choice between 10 Crore vs 1 Rupee with exponential growth is a compelling illustration of why understanding financial principles is crucial. Beyond the hypothetical example (Practical examples of compound interest) , the real-world application of these lessons can transform your financial future.

By embracing the power of compounding, making informed investment decisions, and practicing patience, you can unlock unparalleled financial growth – starting from wherever you are today.

Jugaad on Two Wheels: The Hilarious Bike Parcel Hack in Karnataka

The Great Karnataka Bike Parcel Hack: A Jugaad Masterclass #RapidoParcel: In a creative yet controversial move, ride-hailing platform Rapido has found a way around Karnataka’s

Denmark’s Digital Sovereignty Revolution: Linux and LibreOffice Lead the Way

Introduction to Denmark’s Bold Move In June 2025, Denmark’s Ministry of Digital Affairs made headlines by embracing digital sovereignty, ditching Microsoft Windows and Office 365

🏏Sports as a Business Strategy: Insights from Vijay Mallya’s RCB Ownership

🧠 Sports as a Business Strategy (Tool) In modern business, few platforms offer better engagement and emotional connection than sports. From football clubs in Europe

🙏 Apologies in Leadership: Vijay Mallya Public Apology

🧠 Introduction: The Role of Apologies in Leadership In the corporate world, apologies aren’t signs of weakness—they’re strategic acts of leadership. When made with sincerity

Audiobook Production Costs: Navigating Recording Artists, Studio Expenses, and AI’s Impact

The audiobook industry is booming, with over 130 million listeners in the U.S. alone in 2021 and a growing global appetite for audio content. Producing

Media Trial of Vijay Mallya: How Public Perception Shaped Vijay Mallya’s Legacy

Introduction: Media’s Influence on Business Narratives In today’s hyper-connected world, media narratives can make or break a business reputation. For Vijay Mallya, once known as