Forget everything you thought you knew about New NPS! The National Pension System has undergone a monumental transformation, emerging like a sleek, powerful NPS 2.0. These aren’t minor tweaks; they’re game-changing enhancements that could revolutionize your retirement planning. Are you ready to unlock greater control, flexibility, and potential returns for your golden years? Then buckle up, because we’re diving into the 6 transformative changes that make NPS 2.0 un-ignorable for anyone serious about a secure and fulfilling retirement.

Table of Contents

ToggleChange -1 Nearly Tax-Free final withdrawals!

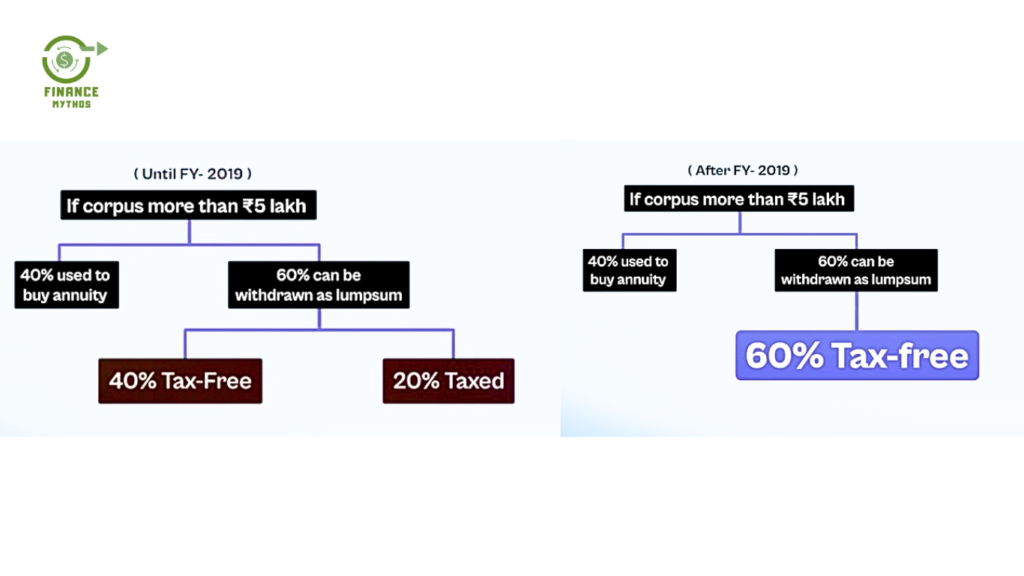

The National Pension System (NPS) proves to be a valuable retirement savings tool, allowing individuals to make their final withdrawal at the age of 60. In a significant move, the Union Budget of the Financial Year 2020 expanded the limit of tax-free withdrawals from 40% to 60%.

Here’s how it works: An individual can withdraw 60% of their total corpus as a lump sum, completely tax-free. The remaining 40% is earmarked for investment in an annuity plan. To illustrate, if someone has a corpus of ₹ 1 crore, they can withdraw ₹ 60 lakh tax-free and use the remaining ₹ 40 lakh to purchase an annuity.

While the lump sum withdrawals enjoy tax-free status, it’s essential to note that the annuity is subject to taxation based on the individual’s income bracket. The tax implications hinge on the years in which the annuity payments are received.

Calculating the annuity return is straightforward. Assuming a yearly rate of 6%, a Rs 40 lakh annuity would yield an annual return of Rs 2.4 lakh.

In a simplified scenario where the annuity is the only post-retirement income, there will be no income tax liability on the yearly return. This is because it falls under the umbrella of basic tax-free income.

In summary, NPS boasts the coveted EEE (Triple E) status:

- Investment in NPS – Tax-Free

- Gains – Tax-Free

- Final Withdrawal – Tax-Free

This makes NPS a powerful and tax-efficient retirement savings avenue for individuals planning their financial future.

Patial withdrawal

Eligibility for Partial Withdrawal

Commencing a partial withdrawal from your NPS account requires a minimum subscription period of three years. Once this criterion is met, subscribers gain the flexibility to make up to three partial withdrawals during their entire NPS tenure.

Frequency and Limits

- Maximum Withdrawal: Limited to 25% of your NPS contributions, excluding employer contributions.

- Frequency: Subscribers can make up to three partial withdrawals over the entire duration of their NPS account.

- Incremental Contributions: Subsequent withdrawals are allowed only on the incremental contributions made since the last partial withdrawal.

- Exclusion of Returns: Returns generated on contributions are ineligible for partial withdrawal.

Circumstances for Partial Withdrawal allowed.

- Higher Education: NPS funds can be utilized for funding the higher education of your children, including legally adopted ones.

- Marriage Expenses: Subscribers can support marriage costs for their children, including legally adopted ones.

- Residential Property: Funds can be directed towards the purchase or construction of a residential property in your name or jointly with your spouse.

- Specified Illnesses: Partial withdrawals are permitted for hospitalization and treatment related to specified illnesses.

- Skill Development: Funds can be utilized for skill development, re-skilling, or self-development activities.

- Entrepreneurial Pursuits: NPS allows withdrawals for establishing a venture or start-up, following guidelines set by PFRDA.

Exceptions for House Purchase or Construction

- Existing Property: Subscribers who already own a house cannot withdraw for the purchase or construction of another one.

- Joint Ownership: Withdrawals are not permitted if there is an existing property in joint ownership.

Exceptions for Skill Development

- Subscribers seeking withdrawals for skill development will receive the lower of the Course Fee (Training Cost) or the available withdrawal amount.

- Under the new guidelines for the National Pension System (NPS), subscribers can withdraw the full amount, tax-free, if it’s ₹ 5 lakh or less. They don’t have to buy an annuity plan in such cases.

Change -2 Systematic Withdrawals from Your NPS for a Secure Retirement

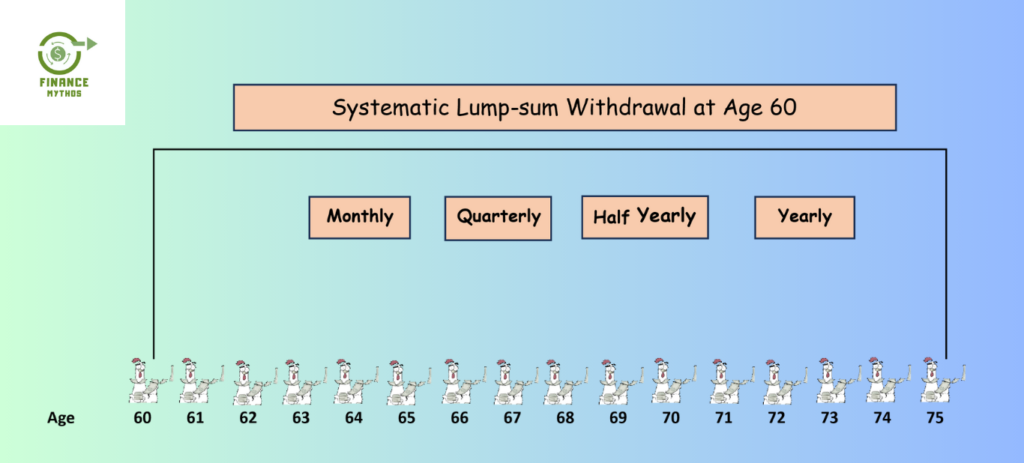

Alright, think of NPS withdrawals like a plan to get regular money from your NPS savings. It’s a bit like how you might have heard of systematic withdrawal plans (SWP) in Mutual Funds. In NPS, it’s called Systematic Lump-sum Withdrawal (SLW).

Think of SLW like a magic trick for your NPS savings. It lets you keep your money working for you for a longer time and gives you a steady income. It’s a bit like having a money fountain that keeps flowing!

Here are the key things to know about SLW:

- You can’t use SLW if you’re just taking out some money early. It’s only for when you’re saying a final goodbye to NPS.

- SLW works on the lump sum part of your savings (that’s 60% of your total money when you retire). But remember, you have to use the other 40% to buy something called an Annuity.

So, if you kick off SLW at 60, you keep getting money regularly until you’re 75.You can choose if you want it monthly, every three months, every six months, or once a year.

SLW in NPS is like a helpful robot for your savings. It lets your money stay invested longer, providing a regular income without the stress of managing a big lump sum. It’s your financial sidekick!

Now, why is SLW handy? Well, it’s like having your NPS savings turn into a pension for you.

- With the 40% set aside for an annuity, you get a pension.

- And with SLW, you get more regular payouts, almost like another pension.

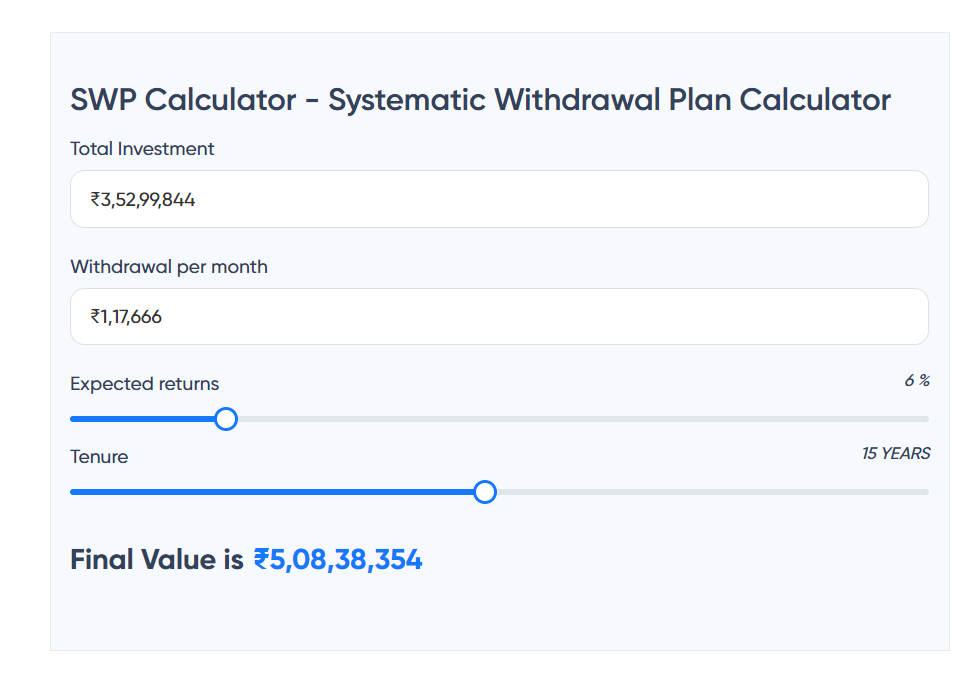

Let’s break it down with an example:

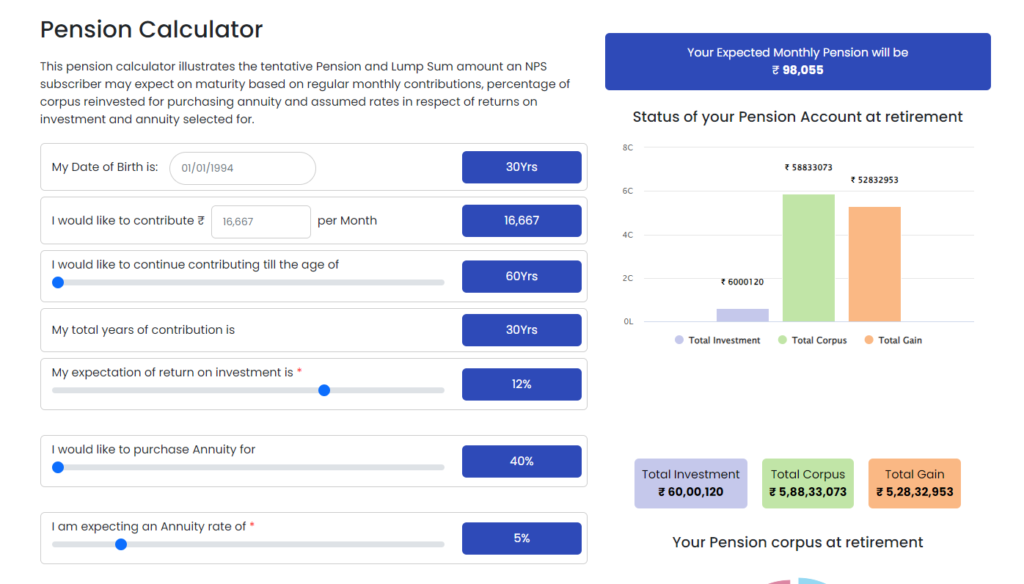

Imagine you start putting ₹ 2 lakh a year in NPS to claim tax deductions,

- ₹ 150,000 under section 80C

- ₹ 50,000 under section 80CCD(1B)

Assuming 12% annualized return, below will be the tentative monthly payment for you.

| Illustration – Pension you get using SWP of NPS | |||

| A | Total Corpus at the age of 60 | 5,88,33,073 | |

| B | Amount Invested in annuity | 2,35,33,229 | 40% of 5.9 Cr |

| C | Remaining 60% for SWP | 3,52,99,844 | 60% of 5.9 Cr |

| D | Monthly Pension from annuity Plan | 98,055 | 5% of B /12 |

| E | Monthly Cash flow from SWP | 1,17,666 | 4% of B /12 |

| Total Monthly In flow | 2,15,721 | ||

By the time you’re 75, even with a modest return of 6%, you could have around ₹5 crores! That’s after getting monthly payouts ₹ 1.17 Lakh for 15 years.

If you choose active money management for 60% of remaining corpus, you can get Higher returns by investing in Mutual funds or any other investment opportunities.

So, in a nutshell, SLW is like turning your NPS savings into a personal pension plan, giving you money regularly. It’s a smart move for a more relaxed retirement.

Change -3 Multiple Annuities from the Same Life Insurance Company

The recent change allowing subscribers to purchase multiple annuity plans from the same life insurance company for their NPS corpus exceeding ₹10 lakh offers greater flexibility and choice during the annuity payout phase. Here’s a breakdown of the details:

Previously:

- Subscribers could only choose one annuity plan from any life insurance company for their entire NPS corpus upon maturity.

Now: If your NPS corpus exceeds ₹10 lakh, you can:

- Split it into smaller amounts and purchase multiple annuity plans from the same life insurance company.

- Choose different annuity options (joint life, immediate annuity, deferred annuity) for each portion based on your specific needs and goals.

What are the benefits?

- Greater customization: You can tailor your annuity income stream to align with your changing needs at different stages of retirement.

- Risk diversification: Spreading your corpus across multiple annuity plans within the same company can potentially mitigate some risk associated with a single plan’s performance.

- Product choice: You can select annuity plans with features that best suit your requirements, such as guaranteed income periods, inflation adjustments, or death benefits.

Change -4 Power of Multiple Fund Managers in the New NPS

The National Pension System (NPS), India’s retirement savings scheme, recently (Dec 23) introduced a game-changer for subscribers: the choice of different fund managers for different asset classes.

What was there earlier (Until November 2023)?

Previously, NPS subscribers had two options:

- Auto Choice: A pre-defined asset allocation based on age, with limited flexibility.

- Active Choice: Choosing one fund manager for all asset classes (Equity, Corporate Debt, Government Bonds, Alternative Assets).

While Active Choice offered some control, it restricted subscribers to the performance of a single fund manager across all asset classes.

What’s new?

Now, under the “Active Choice” in the “All Citizen Model” and “Corporate Model” categories.

- Select up to three different fund managers: Each specializing in a specific asset class, potentially leading to better performance across the board.

- For Alternative Investment asset class – you need to pick one fund manager from the three you’ve already chosen. You can’t go for a new fund manager for this specific choice.

- Tailor their investment strategy: Match their risk appetite and long-term goals with specific fund managers’ expertise.

- Maximize returns: Choose high-performing managers for each asset class, potentially boosting their overall returns.

How does it affect subscribers?

This change empowers subscribers with:

- Greater control: Actively manage their investments and personalize their portfolios.

- Potential for higher returns: Choose managers with proven track records in specific asset classes, potentially maximizing their retirement corpus.

Flexibility to adapt: Adjust their fund choices over time as their risk appetite or goals evolve.

Change -5 Maximize Equity Exposure with the New NPS Active Choice

The National Pension System (NPS) gives you two choices: Active and Auto. In the Active choice, you decide how much of your money goes into different types of investments:

The Active choice allows you to decide your allocation to available asset classes. that is,

- Equity (E)

- Corporate Bonds (C)

- Government Securities (G)

- Alternate Assets (A)

But there’s a rule – you can’t put more than 75% into Equity. Up until October 2022, if you chose 75% in Equity, it would decrease by 2.5% every year after you turn 51. So, by age 60, it would be 50%.

But here’s the cool part: in October 2022, they changed it. Now, if you want, you can keep that 75% in Equity until you’re 60. This means you can potentially make more money from the stock market, but it’s riskier too. If you don’t want the risk, you can still let it taper by 2.5% each year or adjust it yourself.

Now, you can change your investment plan up to 4 times a year. And the good news is, you can defer withdrawing your NPS money until you’re 75, giving you more control.

Oh, and there’s something new for the Tier 2 account – you can go 100% into Equity without any tapering conditions. Before, it was maxed at 75%.

So, basically, you have more freedom and control over your NPS investments now. If you’re willing to take on more risk, you can potentially earn more, but if you prefer a safer approach, you still have options. And hey, you can wait until you’re 75 to start withdrawing your money if that works better for you.

Change -6 Same-Day NAV in NPS: What it Means and How to Avail it!

In the National Pension System (NPS), same-day NAV refers to the ability to purchase units of your chosen scheme at the Net Asset Value (NAV) declared on the same day you make your contribution. This can be beneficial as it allows you to potentially capture market movements and potentially get more units if the NAV is lower on the day of your investment.

Here’s what you need to know about same-day NAV in NPS:

Eligibility:

- Not all NPS contributions qualify for same-day NAV. Currently, only contributions made through the D-Remit facility are eligible. NPS Launched D-Remit facility in Oct 2020.

D-Remit:

- D-Remit is an electronic method that allows you to directly transfer funds from your bank account to the Trustee Bank of NPS. This eliminates intermediaries and facilitates faster processing of your contribution.

Cut-off Time:

- To receive same-day NAV, your contribution through D-Remit must be received by the Trustee Bank before 9:30 AM IST on any working day. Contributions received after this time or on non-working days will be allotted units at the NAV of the next working day.

Minimum Amount:

- The minimum contribution amount through D-Remit is Rs.500 for both Tier I and Tier II accounts.

Activation:

- You need to activate the D-Remit facility through your NPS Central Recordkeeping Agency (CRA) account or your Point of Presence (POP). This involves generating a virtual account number specific to your NPS account.

Benefits:

- Potential to buy more units if the NAV is lower on the day of your investment.

- Faster processing of your contribution compared to other methods.

- Convenient and hassle-free way to invest in NPS.

- D-remit also allows SIP in NPS by setting up standing instructions with the bank.

The evolved NPS is no longer just “another” retirement option; it’s a powerful financial tool with the potential to significantly impact your future. From tailored fund management to multiple annuity choices, the landscape has shifted, offering unprecedented customization and control. Don’t let these transformative changes pass you by. Take the first step towards a brighter financial future by exploring the new NPS and unleashing its retirement-boosting potential. Remember, the power is in your hands – and now, it’s more empowering than ever before.

Jugaad on Two Wheels: The Hilarious Bike Parcel Hack in Karnataka

The Great Karnataka Bike Parcel Hack: A Jugaad Masterclass #RapidoParcel: In a creative yet controversial move, ride-hailing platform Rapido has found a way around Karnataka’s

Denmark’s Digital Sovereignty Revolution: Linux and LibreOffice Lead the Way

Introduction to Denmark’s Bold Move In June 2025, Denmark’s Ministry of Digital Affairs made headlines by embracing digital sovereignty, ditching Microsoft Windows and Office 365

🏏Sports as a Business Strategy: Insights from Vijay Mallya’s RCB Ownership

🧠 Sports as a Business Strategy (Tool) In modern business, few platforms offer better engagement and emotional connection than sports. From football clubs in Europe

🙏 Apologies in Leadership: Vijay Mallya Public Apology

🧠 Introduction: The Role of Apologies in Leadership In the corporate world, apologies aren’t signs of weakness—they’re strategic acts of leadership. When made with sincerity

Audiobook Production Costs: Navigating Recording Artists, Studio Expenses, and AI’s Impact

The audiobook industry is booming, with over 130 million listeners in the U.S. alone in 2021 and a growing global appetite for audio content. Producing

Media Trial of Vijay Mallya: How Public Perception Shaped Vijay Mallya’s Legacy

Introduction: Media’s Influence on Business Narratives In today’s hyper-connected world, media narratives can make or break a business reputation. For Vijay Mallya, once known as

Please let me know if you’re looking for a article writer for your blog. You have some really great articles and I feel I would be a good asset. If you ever want to take some of the load off, I’d really like to write some material for your blog in exchange for a link back to mine. Please send me an e-mail if interested. Thanks!