In the world of business dreams and investments, Refit Global’s appearance on Shark Tank India revealed a story of ambition, challenges, and the tough reality of seeking funding. The founders of Refit Global entered the stage hoping for guidance, support, and financial backing to grow their business.

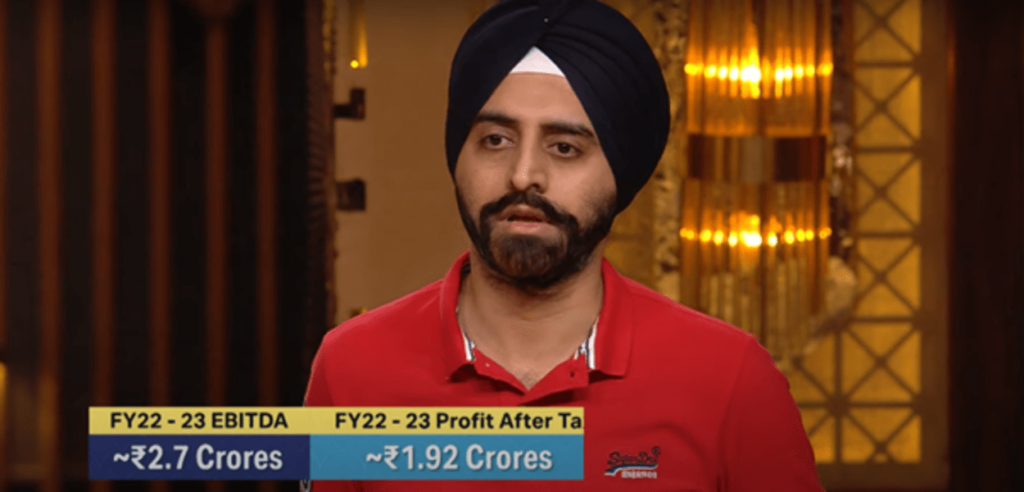

Refit Global had already achieved success with impressive sales of ₹187 crores in FY 22-23 and a solid profit margin of 14%. They proved themselves as a strong player in the refurbished mobile market, showing profit from the start.

But behind the scenes, the negotiation with investors, or “sharks,” showed a different story. The sharks, focused on getting the best deal for themselves, used complex financial terms to confuse the founders and push for terms that favored them.

One tactic used was introducing a royalty clause, which meant the founders would have to pay the investors a percentage of their sales until they made a certain amount of profit. This seemed more like taking advantage of the founders’ lack of expertise rather than helping them succeed.

The sharks also criticized the founders for not being good with numbers, which added pressure and made the founders doubt themselves. This kind of behavior goes against the true spirit of Shark Tank, which is supposed to be about helping entrepreneurs grow their businesses, not making them feel small.

Refit Global’s experience highlights the need for fairness and transparency in investment deals. Entrepreneurship should be about empowering people to succeed, not exploiting their weaknesses.

As we learn from Refit Global’s journey, success in business isn’t just about money. It’s about integrity, collaboration, and staying true to your vision. Let’s strive for an entrepreneurial ecosystem where everyone has a fair chance to succeed, and where mentorship is about lifting each other up, not tearing each other down.

In the end, Refit Global’s story reminds us that true success comes from staying true to yourself and your values, even in the face of challenges. Let’s work together to create a business world where everyone has the opportunity to thrive.

Table of Contents

ToggleRefit Global:Financial Analysis and Comparison

Refit Global’s quest for investment on Shark Tank India led to a proposition from the investors, or “Sharks,” involving a royalty-based agreement. However, a meticulous financial analysis reveals insightful perspectives on the potential costs and benefits associated with this option in comparison to seeking external financing.

Scenario 1 based on ₹ 35 Crores monthly Sales

Below are the variable factors taken for undersetting and calculations.

- Average sale price per phone: ₹7000.

- Last month sales (August 2023): ₹35 Crores and assumed that will continue.

- Total investment: ₹2 crores.

- Royalty will be taken until ₹3 crores is recouped.

Royalty Outflow per Month:= Monthly Sales * Royalty %

= ₹35,00,00,000× 1/100 =₹35,00,000

Time Required for Investors to Recover Investment =Total Royalty/Royalty Outflow per Month

=₹3,00,00,000/₹35,00,000 = 8.57 months’ Time

It will take approximately 8.57 months for the investors (Sharks) to recoup ₹3 crores.

Comparing the cost of investment from Sharks (Royalty option) to borrowing from a bank or NBFCs, even though the 16% rate might seem high, let’s consider the maximum interest rate Refit might face while borrowing ₹2 crores.

- Loan amount needed: ₹2 crores.

- Interest rate: 16% per year

- Duration: 8.57 months

Interest payment for 8.57 Months: Interest Payment

=Loan Amount × Annual Interest Rate/12 ×Number of Months

=₹2,00,00,000×16%/12×8.57=₹22,85,333

In a nutshell, opting for investment from Sharks, as already committed, would entail a cost of ₹3 crores, as outlined in the table below.

However, consider this enchanting alternative: Refit could have pursued a better deal by opting for a ₹2 crore loan from an external source at 16% interest, translating to a significantly lower cost of only ₹22,85,333.

| Financing Option | With Shark Tank | With Outside |

| Equity | 1% Equity | 0% |

| Equity Value at 200 Crore Valuation | 2,00,00,000 | – |

| Interest Cost | – | 22,85,333 |

| Royalty Cost | 1,00,00,000 | – |

| Total Cost to ReFit | 3,00,00,000 | 22,85,333 |

Scenario 2 assuming only ₹ 15 Crores monthly Sales

Average Sales assumed based on FY 22-23 Sales of ₹ 187 Crores – ₹15 Crores

Royalty Outflow per Month: Monthly Sales * Royalty %

= ₹15,00,00,000× 1/100 =₹15,00,000

Time Required for Investors to Recover Investment: Total Royalty/Royalty Outflow per Month

=₹3,00,00,000/₹15,00,000 = 20 months’ Time

It will take approximately 20 months for the investors (Sharks) to recoup ₹3 crores.

Interest payment for 20 Months: =Loan Amount × Annual Interest Rate/12 ×Number of Months

Interest payment for 20 Months: =₹2,00,00,000×16%/12×20=₹53,33,333

Over a span of 20 months, Refit could have amassed substantial savings amounting to approximately ₹46,66,667 (₹1 Crore – ₹53,33,333), in addition to securing 1% equity of the company valued at ₹2 Crores based on a ₹200 Crores valuation.

Financing Option | With Shark Tank | With Outside |

Equity | 1% Equity | 0% |

Equity Value at 200 Crore Valuation | 2,00,00,000 | – |

Interest Cost | – | 53,33,333 |

Royalty Cost | 1,00,00,000 | – |

Total Cost to ReFit | 3,00,00,000 | 53,33,333 |

While the outside loan option appears enticing due to its cost-effectiveness and financial autonomy, it’s essential for Refit to carefully evaluate their financial objectives, risk tolerance, and long-term sustainability. While the investment from Sharks may come with a higher upfront cost, it could potentially offer valuable intangible benefits that extend beyond monetary.

Pros of Choosing Outside Loan Option:

- Cost Efficiency: The outside loan option presents a substantially lower cost compared to the investment from Sharks, saving Refit a considerable sum.

- Financial Flexibility: By securing a loan from an external source, Refit retains greater control over their financial decisions and resources.

- Long-Term Sustainability: Opting for an outside loan fosters a healthier financial outlook, as it mitigates the risk of burdening the company with exorbitant royalty payments.

Cons of Choosing Outside Loan Option:

- Interest Payments: While the interest rate might be lower initially, the cumulative interest payments over time could still amount to a significant sum.

- Creditworthiness Concerns: Depending on Refit’s creditworthiness and financial standing, securing a loan from external sources might pose challenges or necessitate collateral.

- Opportunity Cost: Refit must weigh the potential benefits of the loan against the opportunities lost by not leveraging the investment from Sharks, such as expertise, networking, or strategic partnerships.

Disclaimer: The information provided in this article is for educational and informational purposes only. It does not constitute financial, investment, or legal advice. Readers are advised to consult with professional financial advisors or legal experts before making any financial decisions or investments based on the content of this article. The accuracy, completeness, and reliability of the information presented cannot be guaranteed, and the author and publisher disclaim any liability arising from reliance on the information provided herein.

I’ve been surfing online more than 3 hours today, but

I never found any fascinating article like

yours. It’s pretty value enough for me. Personally, if all website owners and bloggers made

excellent content as you did, the net can be a lot more useful than ever before.

Thank you so much for your kind words! I’m thrilled to hear that you found my article fascinating and valuable. I appreciate your encouragement and support. It’s always motivating to receive feedback like yours. Have a wonderful day!