Are you ready to kickstart your child’s journey to financial stardom?

Well, hold onto your wallets because we’ve got some exciting news! Introducing hassle-free demat account opening for your little investors, and here’s the kicker—it’s completely free! Plus, we’re waving off those pesky Annual Maintenance Charges (AMC). That’s right, folks, it’s time to give your child’s piggy bank a serious upgrade without breaking the bank yourself!

Table of Contents

ToggleWhy It's Crucial for Parents to Open Minor Demat Accounts for Their Children ?

Understanding how to manage finances is a fundamental life skill, yet many Indians find themselves ill-equipped due to the lack of financial education in schools and colleges. As a result, when individuals start earning, they often navigate blindly, making avoidable mistakes or, worse, falling victim to fraudsters and scammers.

That’s where Zerodha steps in. With a mission to empower Indians with financial literacy, Zerodha has been at the forefront of education initiatives for over a decade. From comprehensive Varsity Modules to engaging Varsity Junior video series for kids, they’ve been tirelessly working to bridge the knowledge gap and instil sound financial habits from a young age.

Should you invest in the name minor child ?

Opening a minor demat account isn’t just about investing money to save taxes; it’s about investing in a child’s future. By involving children in financial decisions early on, parents lay the groundwork for lifelong financial literacy. These early lessons not only equip children with the necessary skills to manage their finances responsibly but also instil a sense of ownership and responsibility towards their financial future.

The Importance of Educating Indian Children About Money and Investment

In a country where financial literacy levels are alarmingly low, educating Indian children about money and investment is paramount. By imparting financial knowledge from a young age, we empower the next generation to make informed financial decisions, safeguarding them against financial pitfalls and ensuring their long-term prosperity.

Solving the Problem Through Demat Account Opening

Opening a demat account in a child’s name is a proactive step towards addressing these challenges. It provides a hands-on learning experience, allowing children to track their investments, understand market dynamics, and learn valuable lessons about risk and reward. Additionally, it fosters a collaborative approach to financial management, where parents and children work together towards shared financial goals, strengthening familial bonds in the process.

Why to open minor demat account with Zerodha ? | Why Choose Zerodha for Your Child's Financial Journey?

Zerodha's Free Account Opening

Opening a demat account for your child without spending a dime. Yes, you heard it right! Zerodha is making it rain with free demat account opening, ensuring that your child’s financial journey starts on the right foot.

Zerodha waived AMC Charges

Tired of paying those annual maintenance charges that seem to pop up out of nowhere? Well, fret no more! Zerodha is waving off the AMC charges, giving you one less thing to worry about and more money to invest in your child’s future.

Expert Guidance

With Zerodha by your side, you’re not just opening a demat account; you’re gaining access to a treasure trove of financial wisdom. From investment tips to market insights, our experts are here to guide you every step of the way.

Diverse Investment Options

Whether you’re into stocks, mutual funds, exchange-traded funds (ETFs), Government bonds, and sovereign gold bonds, Zerodha has got you covered. With a wide range of investment options to choose from, you can tailor your child’s portfolio to suit their financial goals and risk appetite.

Control and Transparency

As a guardian, you hold the reins when it comes to managing your minor’s Zerodha account. Minors aren’t authorized to independently purchase securities; their role is primarily to monitor their portfolio and execute sales. However, you, as the guardian, have the authority to gift securities to the minor or facilitate purchases at their request. This allows you to invest in a diverse array of financial instruments on behalf of your child, including stocks, mutual funds, ETFs, government bonds, and sovereign gold bonds. It’s important to note that intraday and F&O trading are off-limits for minor accounts.

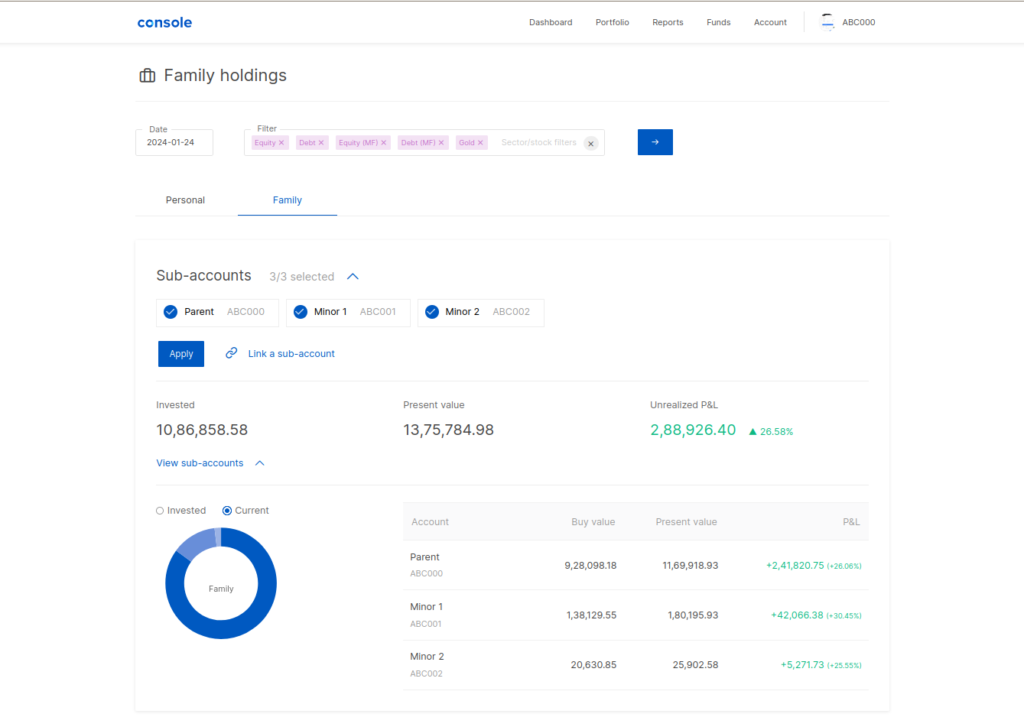

Family Accounts Control and monitoring

Moreover, Zerodha offers a convenient Family Accounts feature on Console, enabling you to oversee both your own portfolio and your child’s investments seamlessly. This consolidated view simplifies the planning process for your child’s financial goals, allowing you to strategize effectively and track progress effortlessly. With Zerodha’s user-friendly interface and comprehensive account management tools, managing your family’s investments has never been easier.

Ready to Take the Plunge?

Don’t let this golden opportunity slip through your fingers! With Zerodha’s free demat account opening and waived AMC charges, there’s never been a better time to kickstart your child’s financial journey. So, what are you waiting for? Join the Zerodha family today and set sail towards a brighter financial future for your child!

Documents required to Open Minor Demat Account Online with Zerodha

• Minor’s PAN

• Minor’s Aadhaar number to verify OTP.

• Proof of date of birth of the minor can be either a birth certificate, school leaving certificate, passport, or mark sheet issued by a higher secondary board.

• A recent photo of the minor.

• Copy of cancelled cheque or bank statement of the minor’s bank account.

• Legal guardian letter, required if the guardian is anyone other than the parent of the minor.

• Guardian’s PAN.

• Guardian’s address proof: Passport, masked Aadhaar, drivers license, or voter ID

• Guardian’s signature.

Step by step process to Open Minor Demat Account Online with Zerodha

To open a minor account online, follow these steps:

- Visit signup.zerodha.com/minor and log in using the guardian’s Zerodha account credentials.

- Verify the guardian profile details and click on Continue. If the guardians profile details have to be modified, see How to modify the guardians profile details while opening a minor account? Once the details are updated, the account can be opened online.

- Enter the mobile number and email ID, and verify them using OTP.

- Enter PAN and the date of birth of the minor, and click on Continue.

- On the DigiLocker page, enter the Aadhaar number of the minor and click on Next. Enter the OTP received and submit.

- Enter the bank account details of the minor, select the terms and conditions checkbox and click on Continue.

- Proceed to do In-person Verification. Both the minor and guardian must be present during the IPV.

- Upload the required documents¹ and click on Continue.

- Add nominees (optional).

- eSign using the guardian’s Aadhaar.

Once the account opening process is completed, the account will be opened within 48 working hours, and the login credentials will be sent to the registered email ID.