Bank lien – In the dynamic world of banking, unanticipated challenges can disrupt the seamless flow of financial transactions. My recent brush with a seemingly routine banking issue has exposed the complexities and hurdles customers may encounter when dealing with Bank IPO lien marks on their accounts, especially in the context of Initial Public Offerings (IPOs).

Table of Contents

ToggleUnraveling the Bank Lien (IPO) : A Customer's Puzzling Journey to Retrieve Funds

It all began when I stumbled upon the fact that Rs. 13,500 in my Bank account had been slapped with a lien mark. My experience of being both intrigued and concerned about a situation, prompting them to embark on a journey to understand the reasons behind it. However, instead of finding clarity, I discover that the situation is complex and entangled in bureaucratic complexities, likening the experience to navigating through a maze of bureaucratic obstacles.

Hurdles at the Banking Office: Chasing Shadows and Elusive Answers

My initial attempts to seek clarification from the banking office proved to be an exercise in futility. From Person A, whom I usually approached for IPO submissions, to Person B at the Home branch, each encounter led to more confusion than clarity. Person A redirected me to the home branch, and Person B shared a cryptic response about a demat account issue related to IPO application.

Simultaneous Battles: Juggling Between Branches and Customer Care

Undeterred, I visited the Bank – Home Branch, submitting queries to Person B. Simultaneously, I engaged with Customer care via email. However, the unexpected outcome was that instead of simplifying the situation, the dual approach of engaging with both the branch and customer care ended up making the situation more complicated or intricate.

Customer Care Conundrum: An Absurd Odyssey

Venturing into the realm of customer care transformed into an exercise in frustration. The responses received were extremely confusing, challenging, or difficult to understand, likening the experience to trying to navigate through a labyrinth (a maze) while blindfolded. Silly questions, baseless inquiries, and a complete lack of understanding of the issue became the norm. The back-and-forth with customer care, characterized by funny answers and evasive tactics, added to the growing exasperation.

A Glimmer of Hope: RBI Complaint and Intervention

Frustrated by the lack of progress and coherent responses, I turned to the Reserve Bank of India (RBI), hoping for a breakthrough. The RBI intervention, prompted by a complaint, brought a glimmer of hope as it initiated an inquiry into the matter.

The Turning Point: RBI Intervention and the End of the Ordeal

As the RBI stepped in, the wheels of resolution began to turn. The bank’s response indicated an “operational error” related to an IPO application, and the lien was eventually lifted after 3 + months of efforts. While this marked the end of the financial ordeal, it was only the beginning of a new chapter in the pursuit of fair compensation for the challenges endured.

Compensation Quandary: Peanuts for a Three-Month Ordeal

The compensation offered by the bank, a mere Rs. 232.00, raised eyebrows and questions about the adequacy and fairness of such gestures. The arbitrary calculation method, a combination of “FD Rate + 2% for lien period,” failed to address the multifaceted challenges faced during the prolonged ordeal.

A Call for Awareness: Sharing the Absurd Odyssey

In sharing my experience, I aim to shed light on the absurdities and hurdles individuals may face when confronted with similar challenges. Lien marked on accounts can be a bewildering issue, and my story serves as a cautionary tale for others.

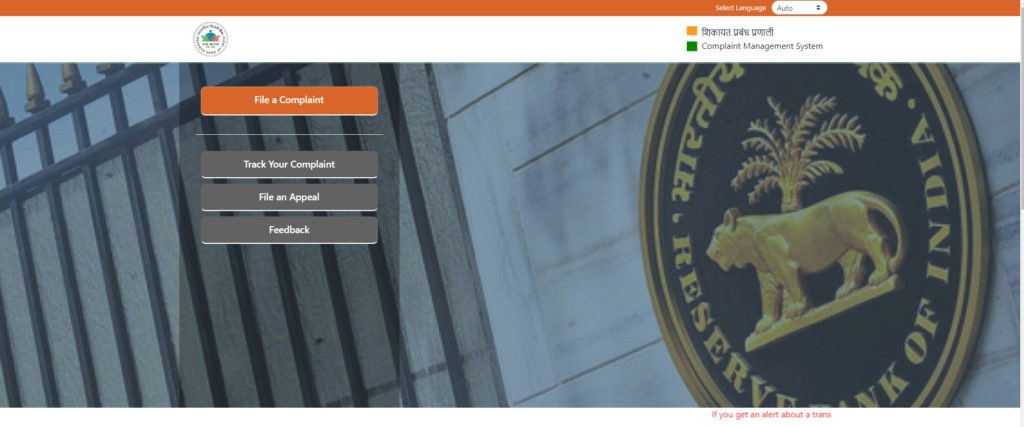

Empowering Others: A Step-by-Step Guide to the RBI Complaint Management System

For those facing similar challenges, here’s a step-by-step guide to approaching the RBI Complaint Management System (Integrated Ombudsman Scheme) for resolution, a beacon of hope in the face of bureaucratic challenges:

- Visit the RBI Complaint Management System (Integrated Ombudsman Scheme) Website: Go to https://cms.rbi.org.in/cms/indexpage.html#eng.

- Select ‘File a Complaint’: Click on the option to file a complaint on the CMS website.

- Provide Necessary Details: Fill in your personal details, including your name, contact information, and the nature of the complaint.

- Specify the Complaint Category: Choose the relevant category for your complaint, such as ‘Banking’ or ‘Customer Service.’

- Narrate Your Grievance: Clearly explain the details of your grievance, including the timeline of events and any communication with the bank.

- Upload Supporting Documents: Attach relevant documents that support your case, such as emails, transaction records, or screenshots.

- Submit the Complaint: Once all details are filled in, submit your complaint through the online portal.

- Track Your Complaint: Keep track of your complaint by using the unique reference number provided by the CMS. This will help you monitor the progress of your case.

By following these steps, individuals can navigate the RBI Complaint Management System and seek a resolution to their banking grievances.

Conclusion: Navigating the Absurdities of Banking

As negotiations for fair compensation continue, this narrative serves as a testament to the need for transparency, efficiency, and customer-centric approaches in banking operations. The complexities of the banking system, coupled with the human element of customer experience, underscore the importance of vigilance and proactive engagement in safeguarding one’s financial interests.

Let this story be a guiding light for those navigating the often absurd and opaque world of banking, empowering them to demand fair treatment and timely resolutions amidst the hassles, hurdles, and customer care conundrums.

FAQs

When was the Reserve bank of India (RBI) nationalized?

The Reserve Bank of India (RBI) underwent nationalization on January 1st, 1949, as mandated by the Reserve Bank of India (Transfer to Public Ownership) Act of 1948. This legislative action facilitated the transfer of all shares in the capital of the Bank to the Central Government, with suitable compensation provided for the transfer.

In which year reserve bank of India (RBI) established / Founded ?

1 April 1935, Kolkata

3 thoughts on “How to get the delayed bank lien for the IPO amount after allotment? | RBI’s Integrated Ombudsman Scheme Rescues”