Anchor investors play a pivotal role in the success of Initial Public Offerings (IPOs). These institutional investors, such as mutual funds, insurance companies, and pension funds, commit to purchasing shares before the IPO opens to the public. Their involvement not only boosts confidence among other investors but also stabilizes the IPO process. This article explores the impact of anchor investors on the long-term performance of IPOs, with a focus on the new SEBI lock-in policies and their effects on market liquidity.

Table of Contents

ToggleImpact of Anchor Investors on Long-Term Performance of IPOs

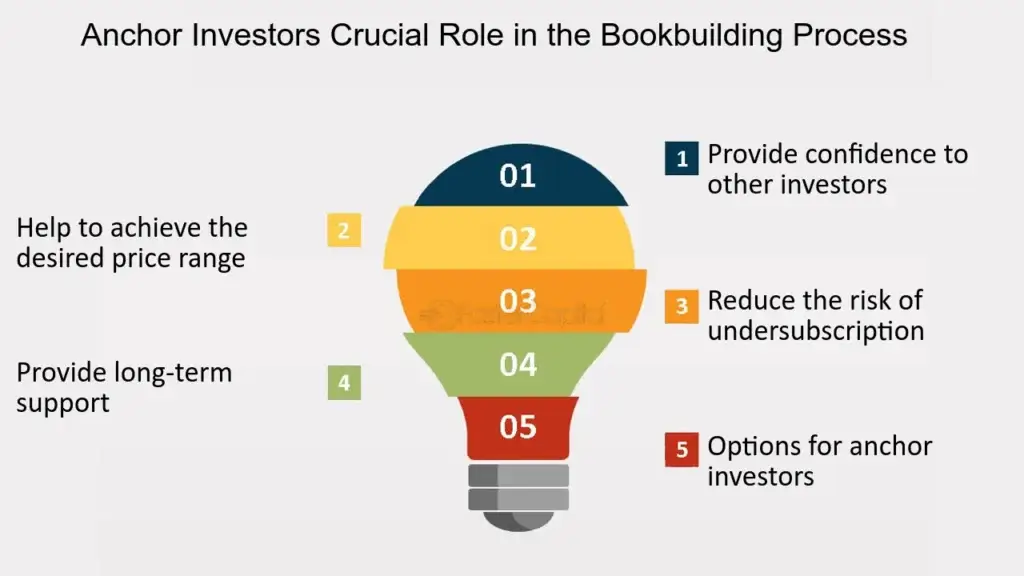

Anchor investors are crucial for the long-term success of IPOs. By committing to a significant portion of shares before the IPO, they signal confidence in the company’s prospects, which can attract more investors and lead to better pricing. This early commitment often results in higher subscription rates and a successful market debut.

Moreover, anchor investors typically hold their shares longer than other categories of investors. This long-term holding can reduce volatility and provide a stable shareholder base, which is beneficial for the company’s stock performance over time. Studies have shown that companies with strong anchor investor backing tend to perform better in the long run compared to those without such support.

SEBI Lock-In Policies for Anchor Investors

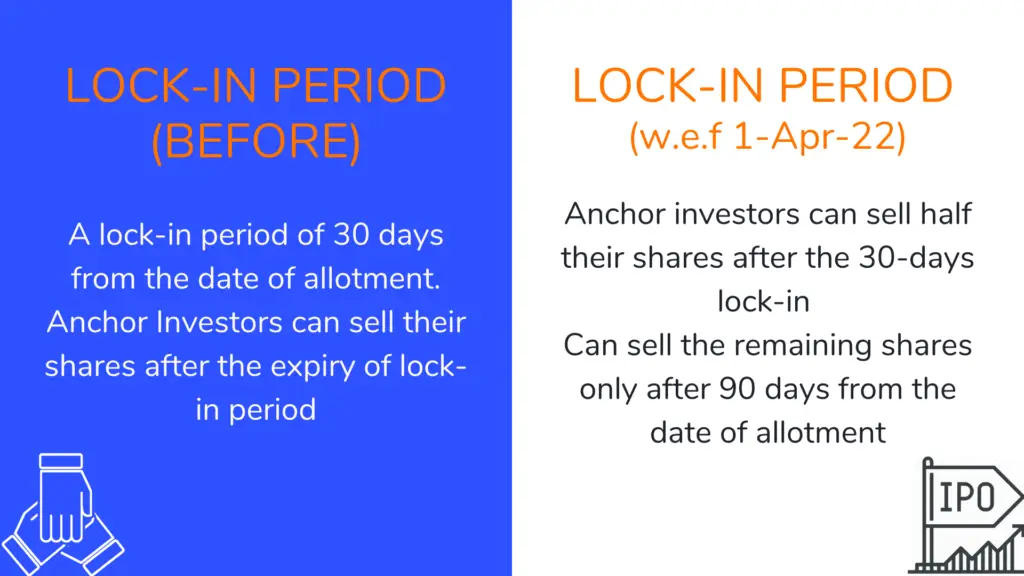

The Securities and Exchange Board of India (SEBI) has introduced new lock-in policies for anchor investors to further stabilize the IPO market. Previously, anchor investors were required to hold their shares for a minimum of 30 days. However, the new regulations extend this lock-in period to 90 days for 50% of the shares allotted to them. This change aims to ensure that anchor investors remain committed to the company for a longer period, thereby reducing the chances of a sudden sell-off that could negatively impact the stock price.

Lock-In Policies effects on Market Liquidity

While the extended lock-in period is beneficial for the stability of the stock, it can have mixed effects on market liquidity. On one hand, it ensures that a significant portion of shares remains off the market for a longer period, which can reduce short-term volatility. On the other hand, it can also limit the availability of shares for trading, potentially leading to lower liquidity in the initial months following the IPO.

However, the presence of anchor investors generally boosts overall market confidence, which can offset the potential downsides of reduced liquidity. Retail and other institutional investors are more likely to invest in an IPO that has strong anchor investor backing, knowing that these investors have a vested interest in the company’s long-term success.

Risks of Over-Reliance on Anchor Investors in IPOs

Anchor investors play a crucial role in IPOs by providing early commitment and stability, but relying too heavily on them comes with risks. Over-reliance can lead to market manipulation, reduced liquidity, and the potential for stock overvaluation, especially when anchor investors control a significant portion of shares. The exit strategy of anchor investors, typically after their lock-in period, can trigger sudden price drops, affecting market perception. Furthermore, an excessive focus on institutional investors may limit retail participation, disrupting a balanced shareholder base. A diversified investor approach is essential to ensure long-term stability and liquidity in IPO markets.

Click here to know – The Hidden Dangers of Anchor Investors in IPOs

Market Manipulation Risks Posed by Anchor Investors in IPOs

Anchor investors can sometimes engage in market manipulation by artificially influencing stock prices or trading volumes. Tactics such as price support, coordinated buying and selling, and wash trading create a misleading appearance of high demand or liquidity. Anchor investors may also exploit their access to insider information or take advantage of lock-in periods, supporting stock prices temporarily before selling off shares, which can lead to a sudden price drop. While regulatory bodies like SEBI have rules in place to prevent such manipulation, the risk persists, and investors must stay vigilant to avoid being misled by these practices.

Conclusion

Anchor investors are indispensable to the IPO process, providing stability and confidence that can lead to better long-term performance. The new SEBI lock-in policies further enhance this stability by ensuring that anchor investors remain committed for a longer period. While there may be some impact on market liquidity, the overall benefits of having anchor investors far outweigh the drawbacks. As the IPO market continues to evolve, the role of anchor investors will remain crucial in shaping the success of new public offerings.

Jugaad on Two Wheels: The Hilarious Bike Parcel Hack in Karnataka

The Great Karnataka Bike Parcel Hack: A Jugaad Masterclass #RapidoParcel: In a creative yet controversial move, ride-hailing platform Rapido has found a way around Karnataka’s

Denmark’s Digital Sovereignty Revolution: Linux and LibreOffice Lead the Way

Introduction to Denmark’s Bold Move In June 2025, Denmark’s Ministry of Digital Affairs made headlines by embracing digital sovereignty, ditching Microsoft Windows and Office 365

🏏Sports as a Business Strategy: Insights from Vijay Mallya’s RCB Ownership

🧠 Sports as a Business Strategy (Tool) In modern business, few platforms offer better engagement and emotional connection than sports. From football clubs in Europe

🙏 Apologies in Leadership: Vijay Mallya Public Apology

🧠 Introduction: The Role of Apologies in Leadership In the corporate world, apologies aren’t signs of weakness—they’re strategic acts of leadership. When made with sincerity

Audiobook Production Costs: Navigating Recording Artists, Studio Expenses, and AI’s Impact

The audiobook industry is booming, with over 130 million listeners in the U.S. alone in 2021 and a growing global appetite for audio content. Producing

Media Trial of Vijay Mallya: How Public Perception Shaped Vijay Mallya’s Legacy

Introduction: Media’s Influence on Business Narratives In today’s hyper-connected world, media narratives can make or break a business reputation. For Vijay Mallya, once known as

1 thought on “The Role of Anchor Investors in IPOs: A Long-Term Perspective”