Table of Contents

ToggleHustle Now, Cry Later? 😅

“Rise and grind.” “Sleep is for the weak.” “You can rest when you’re rich.” Sound familiar?

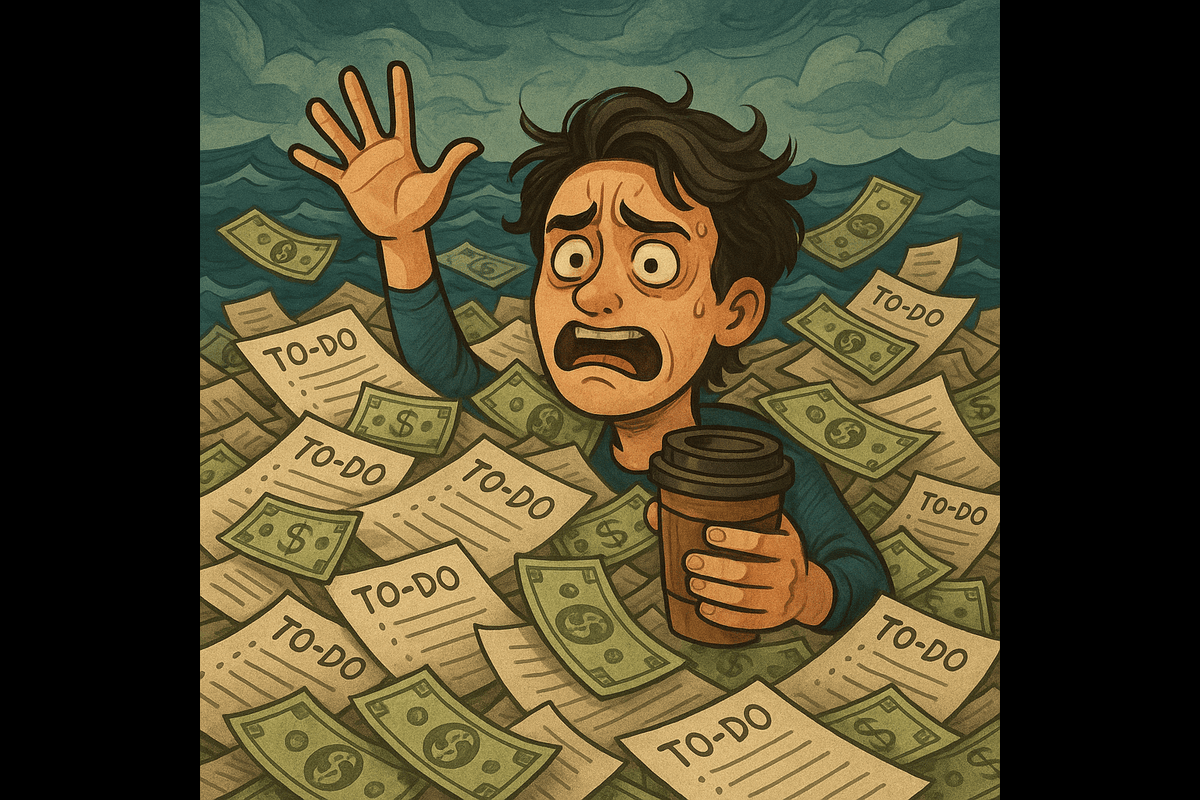

Well, if you’ve been burning the candle at both ends, your brain and your bank account might just be screaming, “Please stop.”

In this blog, we’re diving into why hustle culture isn’t the financial flex we thought it was – and how it’s silently breaking not just your budget, but also your brain.

The Myth of Infinite Productivity ⌚️

We’ve been sold the idea that if we just work harder, longer, faster – we’ll make it big.

But here’s the kicker: productivity doesn’t equal prosperity. In fact, studies show that overworking leads to poor decision-making, impulsive spending (hello, 2AM Amazon splurges), and burnout-driven financial sabotage.

Financial Burnout Is a Real Thing 🚩

Ever stress-bought a giant pizza, only to regret both the price and the carbs?

That’s financial burnout. When your brain is fried from overwork, your ability to budget wisely gets deep-fried too. Hustle culture trains us to reward ourselves with spending – which ironically leads to more stress.

Work-Life Balance: Not Just a Buzzword ☕️🌄

Healthy work-life balance isn’t a luxury; it’s a budget-saving necessity.

When you’re rested, your spending becomes mindful. When you’re burnt out, your credit card becomes your emotional support animal.

Let’s be real: self-care is cheaper than therapy and debt consolidation.

Read More about – 8+8+8 Rule to Your Life

How to Break Free (Without Quitting Your Job and Moving to Bali) 🌴

Set financial boundaries like you set Zoom call limits.

Track your time as religiously as your steps.

Automate savings, so your tired self doesn’t sabotage tomorrow’s self.

Schedule breaks (actual ones, not the scroll-on-Instagram kind).

Re-evaluate priorities—money is a tool, not a trophy.

TL;DR: Hustle Culture = Bad Math ✅

More hustle ≠ more money. More hustle ≠ more happiness. More hustle = more stress, more spending, and less peace.

Let’s stop glorifying exhaustion and start budgeting for joy.

FAQ Section

1. What is hustle culture? Hustle culture promotes constant work, glorifying busyness as a badge of success, often at the cost of mental and financial health.

2. How does hustle culture affect your budget? It leads to burnout-induced spending, poor money decisions, and neglect of financial planning.

3. Can financial stress affect mental health? Yes, prolonged budget stress can trigger anxiety, depression, and even physical health issues.

4. What are signs of financial burnout? Overspending, avoidance of money tasks, fatigue, and feeling hopeless about finances.

5. How can I improve work-life balance on a budget? Prioritize low-cost self-care, set work boundaries, and track your time as intentionally as you track your money.

6. Is productivity overrated in finance? Yes—rested minds make better decisions than overworked ones. Productivity isn’t everything.

7. What’s the link between hustle and impulse spending? Burnout increases stress, and stress fuels emotional purchases—aka budget sabotage.

8. Are side hustles contributing to burnout? Sometimes. While extra income is great, overcommitting leads to physical and mental exhaustion.

9. How can I stop hustle guilt? Redefine success. It’s okay to rest. Financial peace is also a goal worth hustling for.

10. How do I replace hustle with healthy habits? Build a daily routine with time for sleep, meals, movement, and financial check-ins.

Jugaad on Two Wheels: The Hilarious Bike Parcel Hack in Karnataka

The Great Karnataka Bike Parcel Hack: A Jugaad Masterclass #RapidoParcel: In a creative yet controversial move, ride-hailing platform Rapido has found a way around Karnataka’s

Denmark’s Digital Sovereignty Revolution: Linux and LibreOffice Lead the Way

Introduction to Denmark’s Bold Move In June 2025, Denmark’s Ministry of Digital Affairs made headlines by embracing digital sovereignty, ditching Microsoft Windows and Office 365

🏏Sports as a Business Strategy: Insights from Vijay Mallya’s RCB Ownership

🧠 Sports as a Business Strategy (Tool) In modern business, few platforms offer better engagement and emotional connection than sports. From football clubs in Europe

🙏 Apologies in Leadership: Vijay Mallya Public Apology

🧠 Introduction: The Role of Apologies in Leadership In the corporate world, apologies aren’t signs of weakness—they’re strategic acts of leadership. When made with sincerity

Audiobook Production Costs: Navigating Recording Artists, Studio Expenses, and AI’s Impact

The audiobook industry is booming, with over 130 million listeners in the U.S. alone in 2021 and a growing global appetite for audio content. Producing

Media Trial of Vijay Mallya: How Public Perception Shaped Vijay Mallya’s Legacy

Introduction: Media’s Influence on Business Narratives In today’s hyper-connected world, media narratives can make or break a business reputation. For Vijay Mallya, once known as