The world of Initial Public Offerings (IPOs) often defies traditional financial logic. A prime example of this is the disposition effect, a behavioral bias where investors are more likely to sell appreciated shares while holding onto those that have lost value. This article explores the disposition effect among IPO investors, its roots in behavioral finance theories, and its broader market implications.

Table of Contents

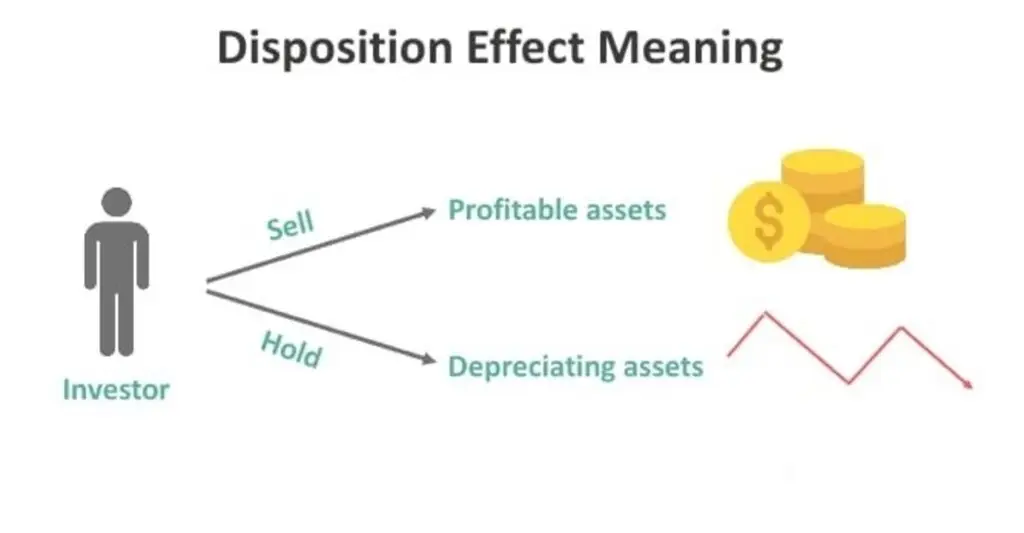

ToggleUnderstanding the Disposition Effect

The disposition effect refers to the tendency of investors to sell assets that have increased in value while holding onto depreciating ones, contrary to the rational strategy of selling losers and holding winners. This phenomenon is particularly observable in IPO investments, where the common purchase price makes it more pronounced.

Theories Behind the Disposition Effect

Prospect Theory

Developed by Daniel Kahneman and Amos Tversky, prospect theory explains that investors are risk-averse regarding gains but risk-seeking when facing losses, leading to irrational decisions.Mental Accounting

Investors mentally separate their investments, treating gains and losses differently. This can lead to irrational behavior, especially when applied to IPO investments.

Empirical Evidence in IPO Markets

A recent SEBI report confirms the strong presence of the disposition effect among Indian IPO investors. Investors quickly sell shares with positive listing gains but hold onto those that depreciate, hoping for recovery.

Key Factors Influencing the Disposition Effect

Several factors contribute to the disposition effect among IPO investors:

Loss Aversion: Investors’ aversion to realizing losses is a significant driver of the disposition effect. The pain of a realized loss is often perceived to be greater than the pleasure of an equivalent gain.

Overconfidence: Overconfident investors might hold onto losing stocks, believing that their initial investment decision was correct and that the stock will eventually recover.

Regret Aversion: The fear of regret can also lead investors to hold onto losing stocks. Selling at a loss would mean admitting a mistake, which many investors are reluctant to do.

Anchoring: Investors often anchor to the IPO price, using it as a reference point. This can lead to irrational decision-making, as they might hold onto losing stocks in the hope that prices will revert to the anchor.

Market Implications of the Disposition Effect

The disposition effect has several implications for the broader market:

Trading Volume: The disposition effect can lead to increased trading volume when stocks surpass their IPO price, as investors rush to lock in gains. Conversely, trading volume may decrease when stocks trade below the IPO price, as investors hold onto their losing positions.

Price Patterns: The disposition effect can contribute to price patterns such as momentum and reversal. Stocks that have performed well may continue to do so as investors sell winners, while stocks that have performed poorly may continue to underperform as investors hold onto losers.

Market Efficiency: The disposition effect can lead to market inefficiencies, as prices may not fully reflect all available information. This can create opportunities for informed investors to exploit these inefficiencies.

Real-Life Examples of the Disposition Effect

Alice’s Investment Dilemma: Alice owns two stocks: Stock A and Stock B. She bought both at the same price. Over the next year, Stock A gains 20% in value, while Stock B loses 20%. Instead of holding onto Stock A to potentially benefit from further gains, Alice sells it to lock in her profit. Meanwhile, she holds onto Stock B, hoping it will recover, even though it continues to decline.

The Summer Travel Plan: Imagine you need money for an upcoming summer vacation. You look at your investment portfolio and decide between selling shares of two companies: Company A, which has increased in value, and Company B, which has decreased. You decide to sell Company A to secure a profit and hold onto Company B, hoping it will rebound. This decision, driven by the disposition effect, often results in missed opportunities for further gains and continued losses.

These examples highlight how the disposition effect can lead to suboptimal investment decisions, as investors tend to sell winning investments too early and hold onto losing ones for too long. Understanding this bias can help investors make more rational and informed decisions.

Overcoming the Disposition Effect

Overcoming the disposition effect can be challenging, but with awareness and strategic approaches, investors can make more rational decisions. Here are some strategies to help mitigate this bias:

Set Clear Investment Goals: Define your investment objectives and time horizons. Having clear goals can help you stay focused and avoid making impulsive decisions based on short-term market movements.

Use Stop-Loss Orders: Implementing stop-loss orders can help you automatically sell a stock when it reaches a certain price, preventing you from holding onto losing investments for too long.

Regular Portfolio Reviews: Periodically review your portfolio to assess the performance of your investments. This can help you make objective decisions based on current market conditions rather than emotional biases.

Diversification: Diversify your investments across different asset classes and sectors. This can reduce the impact of any single investment’s performance on your overall portfolio, making it easier to make rational decisions.

Seek Professional Advice: Consulting with a financial advisor can provide you with an objective perspective on your investments. Advisors can help you develop a disciplined investment strategy and avoid emotional decision-making.

Educate Yourself: Understanding behavioral finance and the common biases that affect investors can help you recognize and counteract these tendencies in your own decision-making.

Keep a Trading Journal: Maintain a record of your investment decisions, including the reasons behind buying or selling a stock. Reviewing your past decisions can help you identify patterns of behavior and improve your future investment strategies.

Focus on Fundamentals: Base your investment decisions on the fundamental analysis of a company’s financial health and growth prospects rather than short-term price movements.

The disposition effect significantly influences IPO investor behavior, leading to early selling of winners and prolonged holding of losers. Rooted in behavioral finance theories like prospect theory and mental accounting, understanding this bias is essential for creating a more efficient investment environment.

Jugaad on Two Wheels: The Hilarious Bike Parcel Hack in Karnataka

The Great Karnataka Bike Parcel Hack: A Jugaad Masterclass #RapidoParcel: In a creative yet controversial move, ride-hailing platform Rapido has found a way around Karnataka’s

Denmark’s Digital Sovereignty Revolution: Linux and LibreOffice Lead the Way

Introduction to Denmark’s Bold Move In June 2025, Denmark’s Ministry of Digital Affairs made headlines by embracing digital sovereignty, ditching Microsoft Windows and Office 365

🏏Sports as a Business Strategy: Insights from Vijay Mallya’s RCB Ownership

🧠 Sports as a Business Strategy (Tool) In modern business, few platforms offer better engagement and emotional connection than sports. From football clubs in Europe

🙏 Apologies in Leadership: Vijay Mallya Public Apology

🧠 Introduction: The Role of Apologies in Leadership In the corporate world, apologies aren’t signs of weakness—they’re strategic acts of leadership. When made with sincerity

Audiobook Production Costs: Navigating Recording Artists, Studio Expenses, and AI’s Impact

The audiobook industry is booming, with over 130 million listeners in the U.S. alone in 2021 and a growing global appetite for audio content. Producing

Media Trial of Vijay Mallya: How Public Perception Shaped Vijay Mallya’s Legacy

Introduction: Media’s Influence on Business Narratives In today’s hyper-connected world, media narratives can make or break a business reputation. For Vijay Mallya, once known as

2 thoughts on “Disposition Effect Among IPO Investors: A Behavioral Finance Insight”