“Beware of little expenses. A small leak will sink a great ship.” – Benjamin Franklin

In our fast-paced world, the allure of early retirement often beckons like a siren song. The idea of escaping the daily grind, sipping piña coladas on a tropical beach, and bidding farewell to alarm clocks can be intoxicating. But before you leap into the sunset, consider this: early retirement is one of the biggest money mistakes you might regret.

Why? Let’s delve into the numbers:

Table of Contents

ToggleLousy Savers

As a collective, we’re not great at saving. Many of us struggle to put away enough for retirement. Early retirement, therefore, becomes unaffordable for most. Financially speaking, it’s generally far safer and smarter to retire later when you’ve had more time to accumulate savings.

Living Standard Decline

According to a Boston College Center for Retirement Research report, half of today’s working families risk a major living standard decline in retirement. However, if everyone were to retire just two years later, that share would drop by roughly 50%. So, delaying retirement can significantly improve your financial prospects.

Baby Boomers’ Dilemma

Take the baby boomer generation, born between 1946 and 1964. Almost half of them have little to no savings. Their median wealth is a mere $144,000, which is less than three years of median household spending. If they had substantial pensions, things might look better, but less than one-third have a pension apart from Social Security.

Social Security Timing

Social Security retirement benefits are often claimed too early. The average benefit is around $18,000 per year but waiting until age 70 can increase it significantly. Unfortunately, 94% of retirees take Social Security well before its benefit peaks. This decision not only affects their own income but also impacts their spouses or ex-spouses who may receive lower benefits.

In summary, while early retirement may seem enticing, it’s essential to weigh the financial consequences. Perhaps Benjamin Franklin was right: those little expenses can indeed sink our financial ships. So, consider saving diligently, investing wisely, and postponing retirement until you’re truly ready. Your future self will thank you! 🌟

Remember, financial security isn’t about how quickly you escape the rat race; it’s about building a sturdy ship that can weather life’s storms. 🚢💰

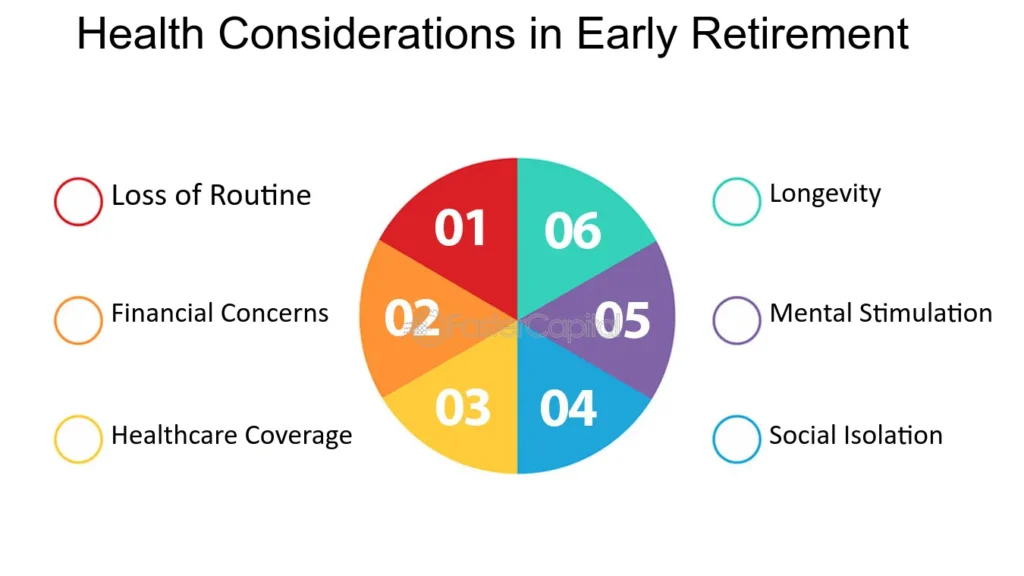

Impact of early retirement on health

The impact of early retirement on health is a topic that has intrigued researchers for years. Let’s explore some findings:

Heart Health and Stroke Risk

- Researchers from the Harvard School of Public Health conducted a study using data from the U.S. Health and Retirement Study. Among 5,422 individuals in the study, those who had retired were 40% more likely to have had a heart attack or stroke than those who were still working.

- Interestingly, this increase was more pronounced during the first year after retirement and levelled off afterward. It suggests that retirement itself may be associated with a decline in health.

A Process, Not an Event

- Retirement is not just a single event; it’s a life course transition involving various changes. These changes include shifts in health behaviours, social interactions, psychosocial stresses, identity, and preferences.

- Some people transition smoothly into retirement, while others find it challenging. Establishing a new social network after retiring is crucial for both mental and physical health. Staying connected with friends and colleagues positively impacts well-being.

Cognitive Health

- Research indicates a connection between early retirement and cognitive decline. The initial stages of retirement can exacerbate mental health challenges such as anxiety and depression.

- Maintaining mental stimulation, social engagement, and purposeful activities during retirement can help mitigate cognitive decline.

Physical Health Outcomes

- A study found that complete retirement leads to:

- A 5-16% increase in difficulties associated with mobility and daily activities.

- A 5-6% increase in illness conditions.

- A 6-9% decline in mental health over an average post-retirement period of six years.

- A study found that complete retirement leads to:

In summary, while some individuals thrive during retirement, others may face health challenges. It’s essential to approach retirement as a process, adapt to changes, and prioritize social connections and mental well-being. Remember, retirement isn’t just about financial planning; it’s also about maintaining a healthy and fulfilling life! 🌟

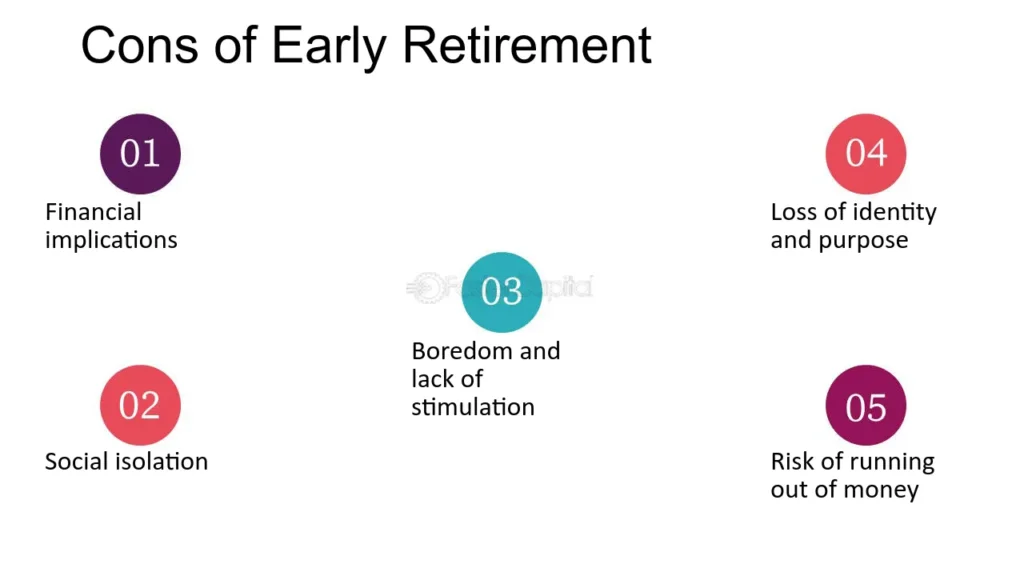

Impact of early retirement on mental health

The impact of early retirement on mental health is a crucial consideration. Let’s delve into it:

Cognitive Decline

- Research shows a connection between the early stages of retirement and cognitive decline. Numerous studies indicate that retirement can exacerbate mental health challenges, including anxiety and depression.

- Without the grounding structure and social bonds of work, new retirees may feel adrift. The brain is a “use it or lose it” organ, and without daily routines or scheduled events, cognitive prowess can wither.

- Verbal memory tends to decline faster after retirement than before. Therefore, maintaining mental stimulation and engaging in stimulating activities is crucial.

Social Connections Matter

- Retiring can lead to reduced social activities. Having strong personal and social connections is essential for mental well-being.

- Creative hobbies, social interactions, and staying engaged with friends and family can help combat feelings of isolation and maintain cognitive health.

Preparation and Perspective

- Early retirement doesn’t have to be detrimental to mental health. It requires preparation, commitment, and a fresh perspective.

- Retirees can find fulfilment, happiness, and contentment by staying mentally active, pursuing hobbies, and building meaningful connections.

Remember, retirement isn’t just about financial planning; it’s also about maintaining a healthy mind and overall well-being! 🌟

Early retirement may seem alluring, but its impact on both finances and health demands careful consideration. Benjamin Franklin’s wisdom reminds us of the importance of managing even the smallest expenses to safeguard our financial stability. The statistics reveal the stark reality: many are ill-prepared for the financial challenges of early retirement, while health risks, from heart disease to cognitive decline, loom large.

Yet, amidst these challenges lie opportunities for proactive planning and mindful living. By prioritizing diligent saving, wise investment, and maintaining social connections and mental stimulation, individuals can navigate the complexities of retirement with greater resilience and well-being.

In the end, the journey to retirement is not just about financial freedom; it’s about ensuring a future of stability, vitality, and fulfillment.

FAQs

How early retirement is killing Britain's productivity?

Early retirement may seem alluring, but its impact on both finances and health demands careful consideration. Benjamin Franklin’s wisdom reminds us of the importance of managing even the smallest expenses to safeguard our financial stability. The statistics reveal the stark reality: many are ill-prepared for the financial challenges of early retirement, while health risks, from heart disease to cognitive decline, loom larEarly retirement can contribute to a decline in Britain’s productivity by reducing the available workforce and the experience and knowledge they bring. When skilled workers leave the workforce prematurely, it can lead to a loss of institutional knowledge, reduced mentorship opportunities, and a strain on pension systems. Additionally, if individuals retire early due to health issues or inadequate retirement savings, they may rely more on government support, further burdening public finances.

How is social security calculated for early retirement?

Social Security benefits for early retirement are calculated based on a combination of factors, including the individual’s earnings history and the age at which they choose to start receiving benefits. While full retirement age is typically 66 or 67, individuals can opt to receive reduced benefits as early as age 62. The benefit amount is reduced for each month before full retirement age, typically resulting in a permanent reduction of around 25% for those who start receiving benefits at age 62.

What is early retirement in Canada?

In Canada, early retirement refers to retiring before reaching the age of 65, which is the standard age for receiving full Canada Pension Plan (CPP) benefits. Individuals can choose to start receiving reduced CPP benefits as early as age 60, but their benefits will be permanently reduced to account for the longer payout period.

What do you think are some consequences of taking money out of your retirement early?

Taking money out of your retirement early can have several consequences, including reducing the amount of funds available for retirement, incurring early withdrawal penalties or taxes, and jeopardizing long-term financial security. Additionally, withdrawing retirement savings prematurely can disrupt compounding growth and limit the ability to meet future financial needs in retirement.

Why is it important to start making retirement plans early in life?

It’s important to start making retirement plans early in life to ensure adequate financial preparation and security in retirement. Starting early allows individuals to take advantage of compounding growth, mitigate the impact of market fluctuations, and develop long-term saving and investment strategies tailored to their goals and risk tolerance.

What age is considered early retirement?

Early retirement age varies depending on the pension scheme or retirement program, but it generally refers to retiring before reaching the full retirement age specified by the program. This age is typically around 65 to 67 years old in many countries.

What is the happiest age to retire?

The happiest age to retire varies for each individual and is influenced by factors such as financial security, health, and personal fulfillment. Some studies suggest that the early years of retirement, typically in the late 50s or early 60s, can be a particularly fulfilling time as individuals have more freedom to pursue hobbies, travel, and spend time with loved ones. However, happiness in retirement is subjective and depends on individual circumstances and outlook.

How early is too early to retire?

The answer to how early is too early to retire depends on individual factors such as financial readiness, health, and personal preferences. Retiring too early may lead to financial strain, inadequate savings, and a longer retirement period to fund. It’s essential to carefully consider the long-term implications of early retirement and ensure that financial plans are robust enough to support a comfortable and secure retirement.

What is the advantage of investing early for retirement?

The advantage of investing early for retirement is the opportunity to harness the power of compounding. By investing early, contributions have more time to grow, increasing the potential for significant returns over time. Additionally, starting early allows individuals to take advantage of dollar-cost averaging and ride out market fluctuations with a long-term perspective.

Jugaad on Two Wheels: The Hilarious Bike Parcel Hack in Karnataka

The Great Karnataka Bike Parcel Hack: A Jugaad Masterclass #RapidoParcel: In a creative yet controversial move, ride-hailing platform Rapido has found a way around Karnataka’s

Denmark’s Digital Sovereignty Revolution: Linux and LibreOffice Lead the Way

Introduction to Denmark’s Bold Move In June 2025, Denmark’s Ministry of Digital Affairs made headlines by embracing digital sovereignty, ditching Microsoft Windows and Office 365

🏏Sports as a Business Strategy: Insights from Vijay Mallya’s RCB Ownership

🧠 Sports as a Business Strategy (Tool) In modern business, few platforms offer better engagement and emotional connection than sports. From football clubs in Europe

🙏 Apologies in Leadership: Vijay Mallya Public Apology

🧠 Introduction: The Role of Apologies in Leadership In the corporate world, apologies aren’t signs of weakness—they’re strategic acts of leadership. When made with sincerity

Audiobook Production Costs: Navigating Recording Artists, Studio Expenses, and AI’s Impact

The audiobook industry is booming, with over 130 million listeners in the U.S. alone in 2021 and a growing global appetite for audio content. Producing

Media Trial of Vijay Mallya: How Public Perception Shaped Vijay Mallya’s Legacy

Introduction: Media’s Influence on Business Narratives In today’s hyper-connected world, media narratives can make or break a business reputation. For Vijay Mallya, once known as

Hello. impressive job. I did not expect this. This is a great story. Thanks!

Thank you for reading !!!

I have been browsing online more than three hours today yet I never found any interesting article like yours It is pretty worth enough for me In my view if all website owners and bloggers made good content as you did the internet will be a lot more useful than ever before

Thank you for reading this !!!