Retail investors in Indian IPOs is experiencing a surge, and a recent SEBI report uncovers an intriguing trend: a significant regional concentration of retail investors. Leading the charge is Gujarat, contributing a staggering 39% of retail IPO investors, with Maharashtra and Rajasthan following behind. But what drives this regional skew? Let’s explore why Gujarat dominates this space and why these states are hotspots for IPO retail investments.

Table of Contents

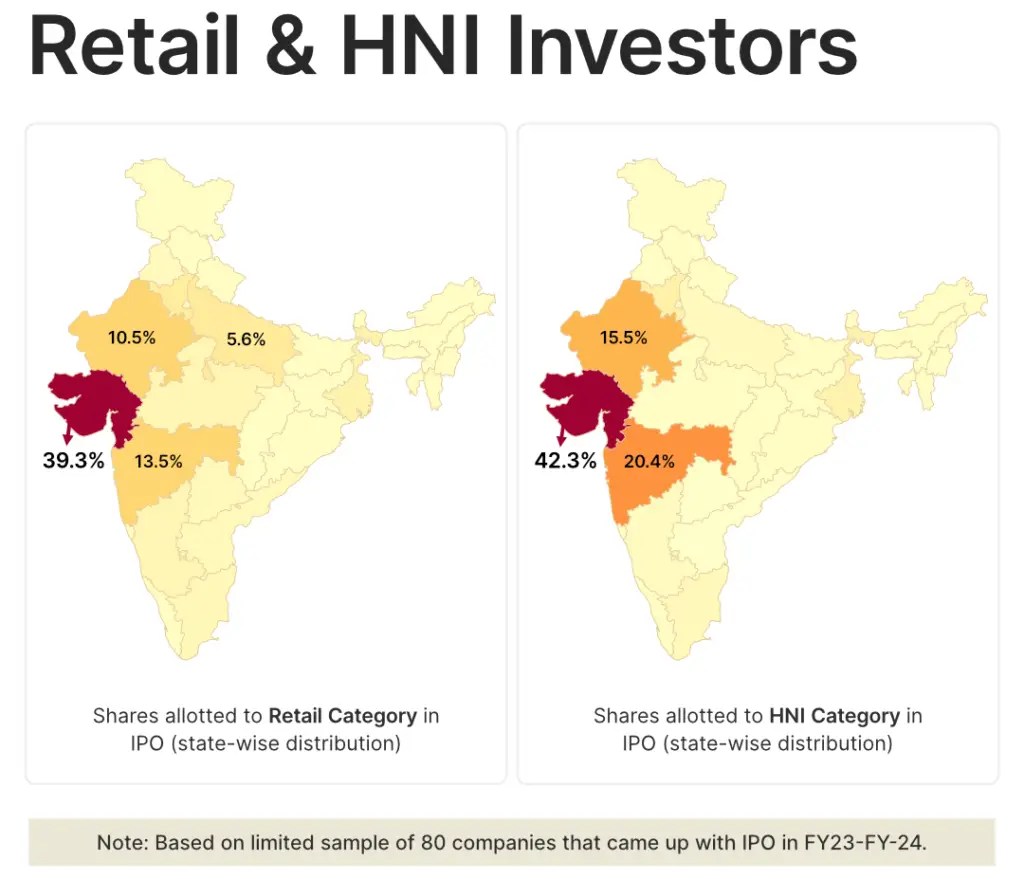

ToggleGeographic Distribution of Retail Investors

According to SEBI, Gujarat leads with 39.3% of retail investors in IPOs, followed by Maharashtra at 13.5% and Rajasthan at 10.5%. This pattern is more than just a statistical anomaly—it reflects deeper socio-economic and cultural factors at play.

Market Culture: The Gujarati Investment Ethos

Gujarat’s dominance stems from a rich market culture rooted in entrepreneurship and trading. Known for its business acumen, the state has ingrained the practice of stock trading into its cultural fabric. As Zerodha’s Nithin Kamath humorously put it, “IPO trading is in the Gujju genes!” This cultural inclination creates fertile ground for retail participation in IPOs, with a long-standing tradition of active investment in the stock market.

Economic Activity: Gujarat’s Thriving Business Hub

Gujarat’s economic prosperity is another key factor. The state is home to diverse industries, including textiles, chemicals, and pharmaceuticals, which bolster its high GDP. This thriving business ecosystem results in higher disposable incomes, which retail investors can channel into IPO opportunities. Additionally, the prevalence of small and medium enterprises (SMEs) creates a vibrant investment environment conducive to retail investment growth.

Investment Infrastructure: Accessibility and Awareness

Gujarat benefits from a well-developed investment infrastructure, including a dense network of brokerage firms, financial advisors, and regular investment seminars. The state’s proactive role in financial literacy programs has significantly boosted retail investor participation, making IPO investment more accessible and understandable for the general populace.

Maharashtra and Rajasthan IPO participation

While Gujarat dominates, Maharashtra and Rajasthan also see significant retail investor participation. Maharashtra’s capital, Mumbai, is India’s financial hub, providing easy access to investment opportunities and information. The state’s robust economic activities attract retail investors.

Rajasthan, though not traditionally known for retail investment, has shown a sharp rise due to increased economic growth and financial literacy efforts. The rise of industries and a focus on promoting entrepreneurship have fueled retail investor interest in IPOs.

Conclusion

The regional concentration of retail investors in Indian IPOs, particularly Gujarat’s dominance, stems from a combination of market culture, economic activity, and investment infrastructure. Understanding these factors offers valuable insights for policymakers aiming to create a more inclusive and widespread retail investor base across India.

Jugaad on Two Wheels: The Hilarious Bike Parcel Hack in Karnataka

The Great Karnataka Bike Parcel Hack: A Jugaad Masterclass #RapidoParcel: In a creative yet controversial move, ride-hailing platform Rapido has found a way around Karnataka’s

Denmark’s Digital Sovereignty Revolution: Linux and LibreOffice Lead the Way

Introduction to Denmark’s Bold Move In June 2025, Denmark’s Ministry of Digital Affairs made headlines by embracing digital sovereignty, ditching Microsoft Windows and Office 365

🏏Sports as a Business Strategy: Insights from Vijay Mallya’s RCB Ownership

🧠 Sports as a Business Strategy (Tool) In modern business, few platforms offer better engagement and emotional connection than sports. From football clubs in Europe

🙏 Apologies in Leadership: Vijay Mallya Public Apology

🧠 Introduction: The Role of Apologies in Leadership In the corporate world, apologies aren’t signs of weakness—they’re strategic acts of leadership. When made with sincerity

Audiobook Production Costs: Navigating Recording Artists, Studio Expenses, and AI’s Impact

The audiobook industry is booming, with over 130 million listeners in the U.S. alone in 2021 and a growing global appetite for audio content. Producing

Media Trial of Vijay Mallya: How Public Perception Shaped Vijay Mallya’s Legacy

Introduction: Media’s Influence on Business Narratives In today’s hyper-connected world, media narratives can make or break a business reputation. For Vijay Mallya, once known as

1 thought on “Regional Concentration of Retail Investors in Indian IPOs: Why Gujarat Leads the Pack”