Table of Contents

ToggleWhat is Quantum Computing?

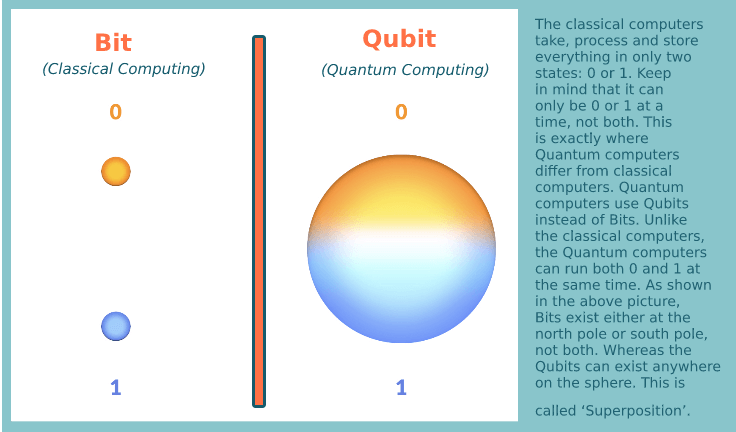

Quantum computing is a type of computing that uses the principles of quantum mechanics. Unlike classical computers, which use bits to represent either 0 or 1, quantum computers use qubits, which can exist in multiple states simultaneously, enabling them to process vast amounts of information at once. This unique capability holds the potential to solve certain complex problems much faster than traditional computers.

How Quantum Computing works?

Quantum computing is a different kind of technology compared to our regular computers. In the computers we use every day, there’s a basic unit of information called a “bit,” which can either be a zero or a one.

Now, quantum computers use something called “qubits.” What makes qubits special is that they can be both zero and one at the same time. This ability to be in multiple states simultaneously is known as “superposition.”

Imagine you have a problem with lots of different possibilities. Regular computers must go through each possibility one at a time, doing calculations each step of the way. It’s like taking a single road to find a solution.

Quantum computers, on the other hand, can explore many possibilities all at once. It’s like having a superhighway with lots of lanes. This ability to check many paths simultaneously makes quantum computers potentially much faster than our regular computers.

So, in simple terms, while regular computers take one road to solve a problem, quantum computers can explore a bunch of roads at the same time, which could make them a lot quicker for certain tasks.

Real life Example

Think of a regular computer like a person trying to find the right key to open a door by trying each key one at a time. Now, imagine a quantum computer as a magical key that can try all the keys at once, making it much faster to open the door. That’s how quantum computers explore possibilities all at the same time, potentially solving problems faster!

Simplifying Quantum Computing with Real-Life Analogies

1. Traffic Lights:

• Regular traffic lights control one intersection at a time.

• Quantum traffic lights could control multiple intersections simultaneously, managing traffic more efficiently.

2. Library Search:

• Regular search is like looking through one book at a time in a library.

• Quantum search is like magically checking all the books at once, finding information much faster.

3. Multiple Choice Test:

• Regular test-taking is answering one question at a time.

• Quantum test-taking is like marking all the correct answers simultaneously, saving time and effort.

4. Cooking Recipes:

• Regular cooking follows one recipe step by step.

• Quantum cooking considers multiple recipes at once, finding the best combination of flavors quickly.

5. Supermarket Checkout:

• Regular checkout scans items one by one.

• Quantum checkout scans all items at once, speeding up the process.

Quantum Computing in Finance

Financial Modelling:

- Classical Approach: In financial modelling, classical computers often use Monte Carlo simulations to project future scenarios and assess risks. However, these simulations can be computationally intensive and time-consuming, especially for complex models.

- Quantum Advantage: Quantum computers could potentially perform parallel Monte Carlo simulations more efficiently. They could explore multiple paths simultaneously, providing quicker insights into various potential financial outcomes. This could significantly speed up the process of risk analysis and scenario modelling.

Portfolio Optimization:

- Classical Approach: Classical computers use optimization algorithms to find the most efficient portfolio based on risk and return metrics. These algorithms typically evaluate different combinations of assets one by one.

Quantum Advantage: Quantum computers, through superposition, could evaluate multiple portfolio configurations simultaneously. This could lead to faster identification of optimal portfolios, especially in scenarios with a large number of assets and complex constraints.

Algorithmic Trading Strategies:

- Classical Approach: Classical computers are used to develop algorithmic trading strategies, but these strategies often require extensive back testing to ensure their effectiveness.

- Quantum Advantage: Quantum computers may enhance the speed of back testing and optimization processes. Their ability to handle large datasets and explore multiple scenarios simultaneously could lead to more sophisticated algorithmic trading strategies and faster adaptation to changing market conditions.

Stock Portfolio Analysis:

- Traditional Computing: Imagine you have a classic computer analyzing a stock portfolio. It looks at each stock individually, one after the other, assessing factors like historical performance and volatility sequentially.

- Quantum Computing: Now, picture a quantum computer examining an entire portfolio simultaneously. It’s like having the ability to consider the performance of all stocks together, exploring different combinations at once. This superposition capability might speed up the process of finding the optimal mix of stocks for better returns.

Risk Assessment:

- Traditional Computing: Classic computers assess risks one by one, considering each financial instrument individually. It’s a sequential process that takes time, especially when dealing with a diverse portfolio.

- Quantum Computing: Quantum computers have the advantage of assessing the risk of multiple financial instruments at the same time. It’s akin to having a holistic view of risk for an entire portfolio in a single computation. The superposition property allows for a more comprehensive risk analysis.

Option Pricing and Market Scenarios:

- Traditional Computing: When it comes to pricing options or predicting market scenarios, classical computers evaluate each potential outcome step by step. They follow a systematic approach to understand how different factors might influence the market.

- Quantum Computing: Quantum computers, on the other hand, can explore various market scenarios simultaneously. It’s like looking at different possible futures all at once. When measuring the outcome, the quantum state collapses, providing a probability distribution for option prices based on multiple potential market developments.

Quantum Computing in Advanced Fraud Detection:

Pattern Recognition:

- Classical Approach: Traditional fraud detection systems use pattern recognition algorithms to identify anomalies in transaction data. However, these algorithms may struggle to keep pace with the evolving tactics of fraudsters.

- Quantum Advantage: Quantum computing’s parallel processing capabilities could improve pattern recognition, allowing for the rapid identification of complex fraud patterns in real-time. This may enhance the ability to detect new and sophisticated fraud techniques.

Machine Learning Speedup:

- Classical Approach: Machine learning algorithms, including those used in fraud detection, can be computationally demanding, especially with large datasets.

- Quantum Advantage: Quantum computers may accelerate machine learning processes, enabling faster training of models. This speedup could lead to more responsive and accurate fraud detection systems, particularly in situations where quick decisions are crucial.

Cryptographic Security:

- Classical Approach: Classical computers use cryptographic techniques to secure financial transactions. However, the rise of quantum computing poses a threat to some existing cryptographic methods.

- Quantum Advantage: Quantum computers could potentially introduce new cryptographic techniques, such as quantum key distribution, which are inherently secure against quantum attacks. This could enhance the overall security of financial transactions and protect against quantum threats.

Challenges in Quantum Computing

Compromised Accuracy:

The instability of qubits stands as a formidable obstacle in the path of quantum computing progress. Unlike classical bits that are firmly in states of either one or zero, qubits can exist in any possible combination of these states. When a qubit changes its status, the accuracy of results is compromised, leading to potential loss or alteration of inputs.

Insufficient Qubit Quantity:

Another pivotal challenge is the inadequate number of qubits for quantum computers to achieve groundbreaking results. Operating at the scale necessary for transformative breakthroughs requires potentially millions of interconnected qubits. Presently, the existing quantum computers fall significantly short of reaching this quantum scale.

Lack of Singular Output:

Quantum computers operate on principles of superposition, allowing for the simultaneous execution of multiple calculations as qubits interact with one another. In contrast to classical computers that provide a clear and singular output, quantum computers offer a range of possible answers when data is input. These characteristic challenges conventional expectations, necessitating innovative approaches to interpreting results.

Extreme Environmental Conditions:

Quantum computing often demands an environment with extremely low temperatures, adding a layer of complexity to its development. The requirement for such low temperatures poses practical challenges, further emphasizing the intricate nature of quantum computing advancement.

As researchers navigate these challenges, the potential of quantum computing remains alluring, promising unprecedented computational capabilities once these obstacles are overcome.

FAQs

Q-1 What is Principles of Quantum Mechanics?

Quantum mechanics is a branch of physics that describes how very small things, like atoms and particles, behave. It introduces concepts like superposition and entanglement, where particles can exist in multiple states simultaneously.

let’s break down the principles of quantum mechanics in simple terms:

- Tiny World Rules: In the super small world of atoms and particles, things don’t follow the same rules as the everyday world. Quantum mechanics helps us understand how these tiny things behave.

- Superposition Magic: Imagine a tiny particle being in multiple places at once, like a magic trick. That’s superposition. It can exist in different states all at the same time.

- Linked Particles: Sometimes, tiny particles become linked or entangled. When one does something, the other reacts instantly, no matter how far apart they are. It’s like having a secret connection.

- Uncertainty Dance: In the quantum world, you can’t predict everything perfectly. There’s a bit of a dance of uncertainty. We can know some things, but not everything all at once.

Q-2 What is 0 or 1 in Classical Computers?

In classical computers, information is represented using bits, which can be either 0 or 1. These are like tiny switches that can be on (1) or off (0), forming the basic language that computers use to process and store data.

Q-3 What is qubits ?

Qubits are the quantum version of bits. Unlike classical bits, qubits can exist in multiple states at the same time due to a property called superposition. This unique feature allows quantum computers to perform complex calculations more efficiently.

Q-5 What is Superposition?

Superposition is a fundamental principle in quantum mechanics. It allows particles, like qubits, to exist in multiple states simultaneously. In the context of qubits, it means they can be both 0 and 1 at the same time. This ability to hold multiple possibilities at once is what gives quantum computers their potential for incredible processing power.

1 thought on “Quantum Computing in Finance: Simplifying Insights for Strategic Growth”