India’s Union Budget – a comprehensive annual financial statement shaping the nation’s economic trajectory. From its origins to the meticulous crafting by the Budget Division, this guide explores the key Government budget components, types of budgets, and Deficit measures, shedding light on fiscal strategies that impact millions.

In the realm of economics, a Budget serves as an estimate of both revenue and expenses during a specific timeframe. Specifically, a Government Budget is an annual financial statement that delineates the expected expenditures and receipts for a financial year. This period spans from April 1 of the current year to March 31 of the subsequent year.

Article 112 of the Indian Constitution designates the Union Budget as the Annual Financial Statement (AFS). Beyond this nomenclature, the Union Budget provides:

Details of Previous Financial Year

-

- An account of the actual receipts and expenditures from the concluding financial year.

-

- Explanation for any deficit or surplus during that period.

Economic and Financial Policy for the Upcoming Year:

-

- Taxation proposals for the upcoming fiscal year.

-

- Revenue expectations and spending programs.

-

- Introduction of new schemes or projects.

In essence, the Union Budget not only encapsulates the financial transactions of the past and present but also serves as a roadmap for the economic and financial policies to be pursued in the forthcoming year.

Table of Contents

ToggleUnion Budget | Origins of the Term ‘Budget’

The term “Budget” finds its origins in the French word “bougette,” which translates to “small leather bag.”

The Father of the Indian Budget

R. K. Shanmukham Chetty holds the title of the Father of the Indian Budget. Notably, he presented the inaugural budget of independent India on November 26, 1947, and served as the first Finance Minister from 1947 to 1949.

It’s worth mentioning that the first budget of India was delivered by British economist James Wilson on April 7, 1860.

Who is responsible to prepare Budgets in India?

Budget Preparation in India: Nodal Authority and Process – The responsibility for crafting budgets in India lies with the Budget Division of the Department of Economic Affairs (DEA) within the Finance Ministry. The Finance Minister of India presents the budget on the first day of February since 2016, a shift from the previous tradition of the last working day of February.

Given that the financial year commences on April 1, the budget must receive approval from the Lok Sabha before taking effect on the 1st of April. Article 112 of the Constitution of India provides detailed provisions regarding the Union Budget.

Components of Union Budget

Union Budget is classified into Revenue Budget and Capital Budget.

Budget Components

Revenue Budget

The Revenue Budget is a comprehensive category encompassing both Revenue Expenditure and Revenue Receipts.

Revenue Receipts

It consists of the money earned by the government through tax such as excise duty, income tax and other non-tax sources such as dividend income, profits, interest receipts. These are receipts which do not have a direct impact on the assets and liabilities of the government.

Revenue Expenditure

Revenue Expenditure pertains to the day-to-day operational costs of the government and the provision of various services to citizens. This type of expenditure does not influence the government’s assets or liabilities. Examples of Revenue Expenditure encompass salaries, interest payments, pensions, and administrative expenses.

Capital Budget

The Capital Budget comprises both Capital Receipts and Capital Expenditure.

Capital Receipts

It indicate the receipts which lead to a decrease in assets or an increase in liabilities of the government.

It consists of:

-

- Money received by selling assets (or disinvestment) such as shares of public enterprises.

-

- Money received in the form of borrowings or repayment of loans.

Capital expenditure

It is used to create assets or to reduce liabilities.

It consists of:

-

- the long-term investments by the government on creating assets such as roads and hospitals

-

- the money given by the government in the form of loans to states or repayment of its borrowings.

Government Deficit: Measures and Implications

A deficit is an amount by which the expenditures in a budget exceed the income. Find below various measures that capture government Deficit.

Revenue Deficit

A Revenue Deficit occurs when the government’s revenue expenditure surpasses its revenue receipts. This deficit specifically involves transactions impacting the current income and expenditure of the government.

When a revenue deficit arises, it signifies that the government is dissaving, utilizing the savings of other sectors in the economy to fund a portion of its consumption expenditure.

Fiscal Deficit

Fiscal deficit is the difference between a government’s total revenue and total expenditure in a fiscal year. It’s an indicator of how much the government needs to borrow to finance its operations.

Primary Deficit

The Primary Deficit is calculated by subtracting interest payments from the fiscal deficit. In essence, it is expressed as the difference between total revenue and total expenditure, excluding interest payments on government debt.

It indicates the maximum amount of borrowing that the government can use.

Types of Budgets in India | What are the 3 main Types of Budgets in India?

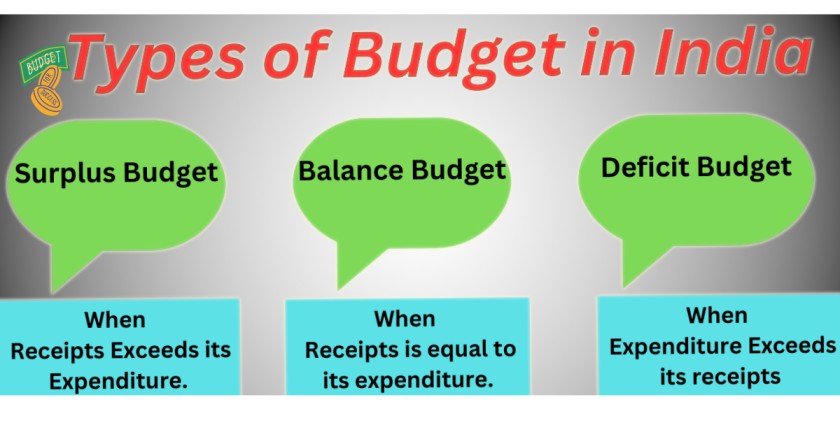

Depending on the feasibility of these estimates, budgets have been categorized into three types.

Surplus Budget

A surplus budget happens when the government is expected to get more money than it plans to spend in a fiscal year.

In times of excessive inflation, a surplus budget becomes a strategic tool for the government. It serves as a mechanism to curtail aggregate demand, effectively contributing to the reduction of inflationary pressures.

In simple words, if there’s too much spending (demand) in the economy, it can contribute to inflation. By using a surplus budget, the government is essentially taking some money out of the economy. When people or businesses have less money to spend, it can help reduce overall demand.

Balanced Budget

A balanced budget occurs when the government expects to receive the same amount of money as it plans to spend in a given year. This means the total planned government expenses are equal to the anticipated income, ensuring a balanced financial state.

Deficit Budget

A deficit budget happens when a government plans to spend more money than it expects to earn in a year. To cover this shortfall, the government might borrow money or use savings from previous surpluses. Deficit budget increases liability of the government since it raises debt or reduces the government’s reserve money.

when a government has a deficit budget, it means they’re intentionally spending more money than they’re earning. They do this to invest in things like infrastructure or social programs in developing countries, and in developed countries, it can help maintain economic stability.

Other Types of Budgets

Zero Based Budgeting

Zero-based budgeting (ZBB) is a way of creating a budget from the beginning, starting with a “zero base.” In the practice of Zero-Based Budgeting (ZBB), each expense undergoes a detailed review, and justification is required for inclusion in every new budget period. This approach looks at the needs and costs of every government function, and the budget is built based on those needs, starting from scratch each time.

Zero-based budgeting in India

In India, the Zero-Based Budgeting (ZBB) approach was introduced by the Department of Science and Technology in 1983. By 1986, the Indian government made it mandatory for all ministries to use ZBB in preparing their expenditure budgets. This method required ministries to thoroughly review their activities and programs, estimating expenses based on ZBB principles. Although the ZBB system gained traction during the seventh Five-Year Plan, sustained progress was limited in subsequent years.

Source – What is Zero-based Budget

Outcome-based budgeting is a thorough way of using public funds. It looks at what goes in, what comes out, and what results we want. This method helps find savings, be more efficient, and reach budget goals. But it’s still new, and many find it tough to put into action. Governments can make it easier by slowly including outcomes in the budget process step by step.

Gender Budgeting

Gender budgeting is a way to check if a government or organization’s budget is fair to both men and women. It looks at where money goes for women, men, and gender-related issues. Gender budgeting ensures that the budget includes everyone and focuses on making things fair for all genders. It’s about assessing budgets with a gender perspective, making sure money supports gender equality. The government uses gender budgeting to allocate funds for development, welfare, and empowerment programs for females.

Conclusion

In conclusion, the Union Budget of India stands as a crucial roadmap for economic policies, reflecting a meticulous review of the nation’s financial health. From its origins in the French “bougette” to the father of the Indian budget, R. K. Shanmukham Chetty, and the responsible Budget Division, we delve into the budget components, types of budget, and measures of government budget. Understanding surplus, balanced, and deficit budgets, along with specialized approaches like Zero-Based Budgeting and Outcome Budget, provides a comprehensive view of fiscal strategies. Embracing gender budgeting signifies a step towards equitable resource allocation. As India evolves its budgeting practices, incorporating gender perspectives and outcome-based assessments, the journey towards a more inclusive and efficient financial framework continues.

FAQs:

1) Who is known as the Father of the Indian Budget?

R. K. Shanmukham Chetty is acknowledged as the Father of the Indian Budget for presenting the inaugural budget of independent India in 1947.

2) What is Zero-Based Budgeting (ZBB)?

Zero-Based Budgeting is an approach where each expense undergoes a detailed review, requiring justification for inclusion in every new budget period.

3) What is Gender Budgeting?

Gender budgeting ensures fair budget allocation for both men and women, focusing on gender equality in financial planning.

4) How does a Surplus Budget impact inflation?

A surplus budget serves as a tool to curtail aggregate demand, helping reduce inflationary pressures during times of excessive spending in the economy.

5) Who Presented the First Budget in India?

The first budget of India was presented by British economist James Wilson on April 7, 1860.

6) How Does a Deficit Budget Impact Government Liabilities?

A deficit budget, where government spending exceeds its income, may lead to increased government liabilities as it borrows money to cover the shortfall.

7) Who Introduced Zero-Based Budgeting in India? Zero-Based Budgeting (ZBB) was introduced in India by the Department of Science and Technology in 1983. By 1986, it became mandatory for all ministries to use ZBB in preparing their expenditure budgets.

8) Who has presented the budget maximum number of times ?

Morarji Desai, a former Prime Minister, holds the distinction of delivering the highest number of Union Budgets in the nation’s history. He presented a total of 10 budgets during his tenure as the Finance Minister from 1962 to 1969.

Following Desai, P. Chidambaram stands as the second-highest, having presented 9 budgets,

while both Pranab Mukherjee and Yashwant Sinha follow closely with 8 budgets each.

Former Prime Minister Manmohan Singh and the fourth Finance Minister, T.T. Krishnamachari, share the achievement of presenting 6 budgets each.

Also read : Indian wedding season business

5 thoughts on “Decoding India’s Union Budget: Origins, Budget Components, and Fiscal Strategies”